Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

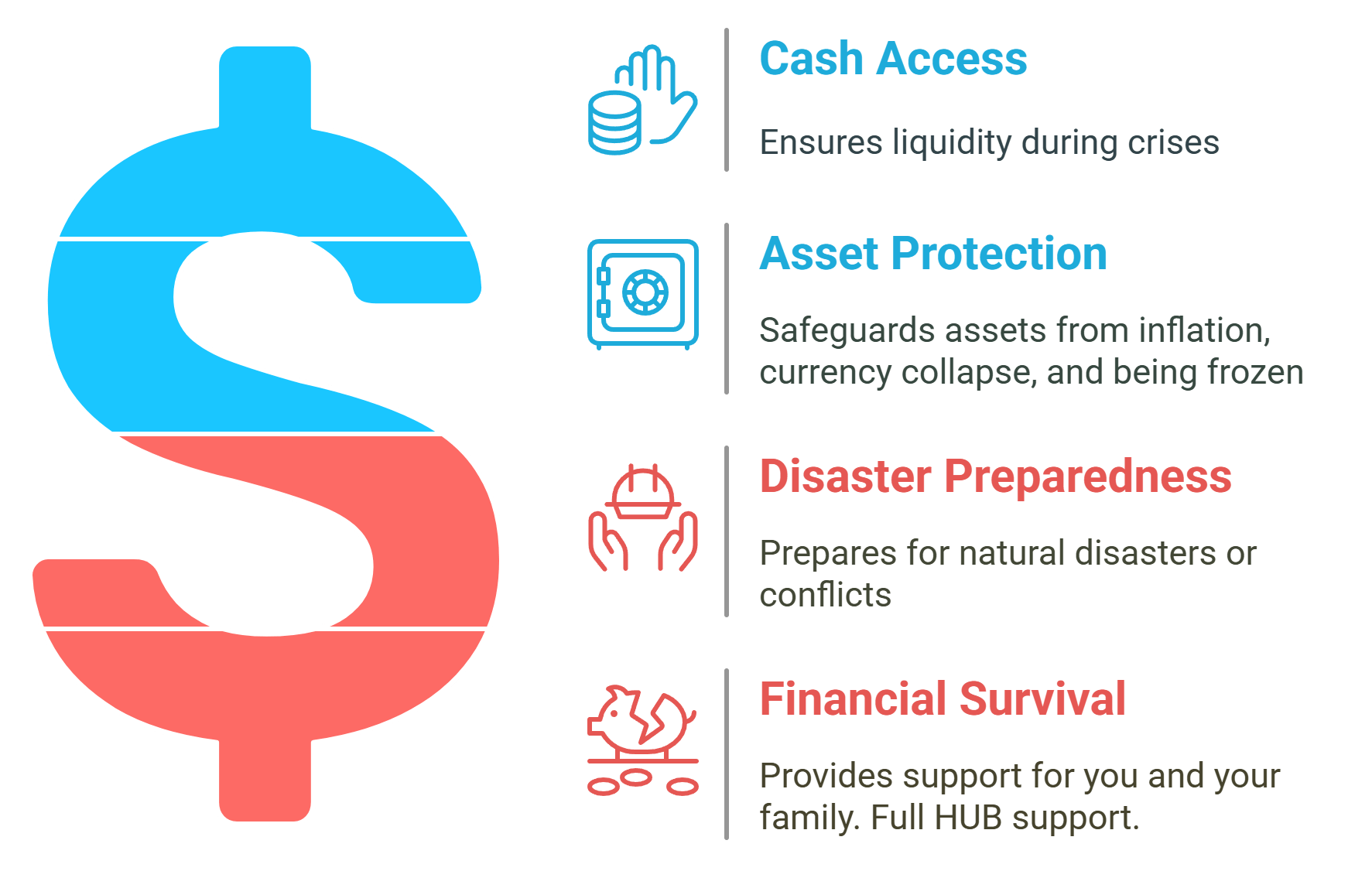

A Financial Go Plan is essential because it provides a resilient financial backup, ensuring you can access vital funds when traditional financial systems are disrupted or your primary assets become unreachable. Here’s a breakdown of why, with examples:

Why it’s a Risk: When a national currency rapidly loses its value (collapse) or experiences extremely high rates of inflation (hyperinflation), the purchasing power of savings held in that currency is decimated. Cash can become virtually worthless, and electronic balances may not keep up with the skyrocketing prices of essential goods and services. A Financial Go Plan, especially one holding assets in stable foreign currencies and gold, can preserve wealth and provide access to usable funds.

Examples (within the last 10-15 years):

Why it’s a Risk: During times of economic crisis, governments may impose capital controls to prevent money from leaving the country and to stabilize the banking system. These controls can severely restrict your ability to access your own funds, especially for international transfers or large withdrawals. Limits can be placed on daily ATM withdrawals, bank transfers abroad, and even the amount of cash you can carry out of the country. A Financial Go Plan with assets held offshore is designed to be outside the reach of such domestic controls.

Examples (within the last 10-15 years):

Why it’s a Risk: While deposit insurance exists in many countries, it often has limits. If a bank fails, access to funds above the insured limit can be delayed or lost. In a “bail-in” scenario (as seen in Cyprus), a failing bank can convert a portion of uninsured deposits (and even some other liabilities) into equity to recapitalize itself, meaning depositors can lose their money or become shareholders in a failing institution. A Go Plan diversifies assets away from a single banking system.

Examples (within the last 10-15 years):

Why it’s a Risk: War and severe political unrest can lead to displacement, destruction of property, breakdown of financial infrastructure, and government seizure or freezing of assets. Individuals may be forced to flee their homes with little notice, leaving behind valuables, cash, and access to local bank accounts. Financial Go Plans provide funds accessible from anywhere, independent of the situation in one’s home country.

Examples (within the last 10 years):

Why it’s a Risk: Natural disasters like floods, fires, earthquakes, and hurricanes can destroy homes or make them inaccessible for extended periods. Any cash, gold, or other valuables hidden at home can be lost, destroyed, or become unreachable. Banking infrastructure (ATMs, branches) can also be offline due to power outages or damage. A Go Plan ensures you have access to funds stored securely elsewhere.

Examples (within the last 10-15 years):

Why it’s a Risk: Individuals, especially business people or those involved in international transactions, can have their assets frozen unexpectedly due to legal disputes, regulatory actions, sanctions, or even mistaken identity. This can happen without warning, cutting off access to operating capital or personal funds. An offshore Go Plan, segregated from primary business or personal accounts, can provide a crucial financial buffer.

Examples:

Why it’s a Risk: Most countries have strict rules about declaring cash, gold, or other monetary instruments when crossing borders. Failure to declare amounts over a certain threshold (commonly around USD/EUR 10,000) can lead to seizure of the assets, hefty fines, and potential criminal charges, even if the money is legitimate. This makes physically transporting large emergency funds risky. A Go Plan provides access via cards or secure services without needing to carry bulk cash/gold.

Examples :

What sets Offshore Zen apart is our commitment to holistic support. We don’t just address isolated issues; we anticipate your needs and provide proactive solutions. Here are some additional benefits of partnering with our Hub:

Why it’s a Risk: While often perceived as secure, safety deposit boxes are not immune to seizure, especially if the providing institution itself is implicated in criminal activity or if law enforcement obtains a warrant believed to cover the boxes. The contents might be seized, and owners may face a difficult process to reclaim legitimate assets. The Financial Go Plan avoids this by not relying on a single physical box in one jurisdiction.

Examples:

The Offshore Zen Financial Go Plan, whether Managed or Self-Managed, provides a vital layer of security in an unpredictable world. By strategically placing liquid assets offshore and combining this with dedicated 24/7 crisis support, it ensures you have the financial means and expert assistance to navigate emergencies effectively. The Managed plan offers speed, simplicity, and enhanced protection for smaller sums, while the Self-Managed plan provides direct control and flexibility for larger amounts, albeit with a more involved setup. Evaluating your specific needs, risk tolerance, and the amount you wish to safeguard will determine the best path forward in building this essential component of your financial resilience.

Life’s uncertainties and complexities demand a partner who’s always ready to help. Offshore Zen’s 24/7 Hub services offer unparalleled support, ensuring you can navigate crises and streamline daily operations with ease. Whether you’re an entrepreneur, an investor, or an expatriate, having Offshore Zen by your side means peace of mind, financial freedom, and the confidence to tackle any challenge.

Don’t wait for the unexpected to happen. Partner with us today and experience the power of having our experts and partners at your disposal, 24/7. Arrange a free meeting here.

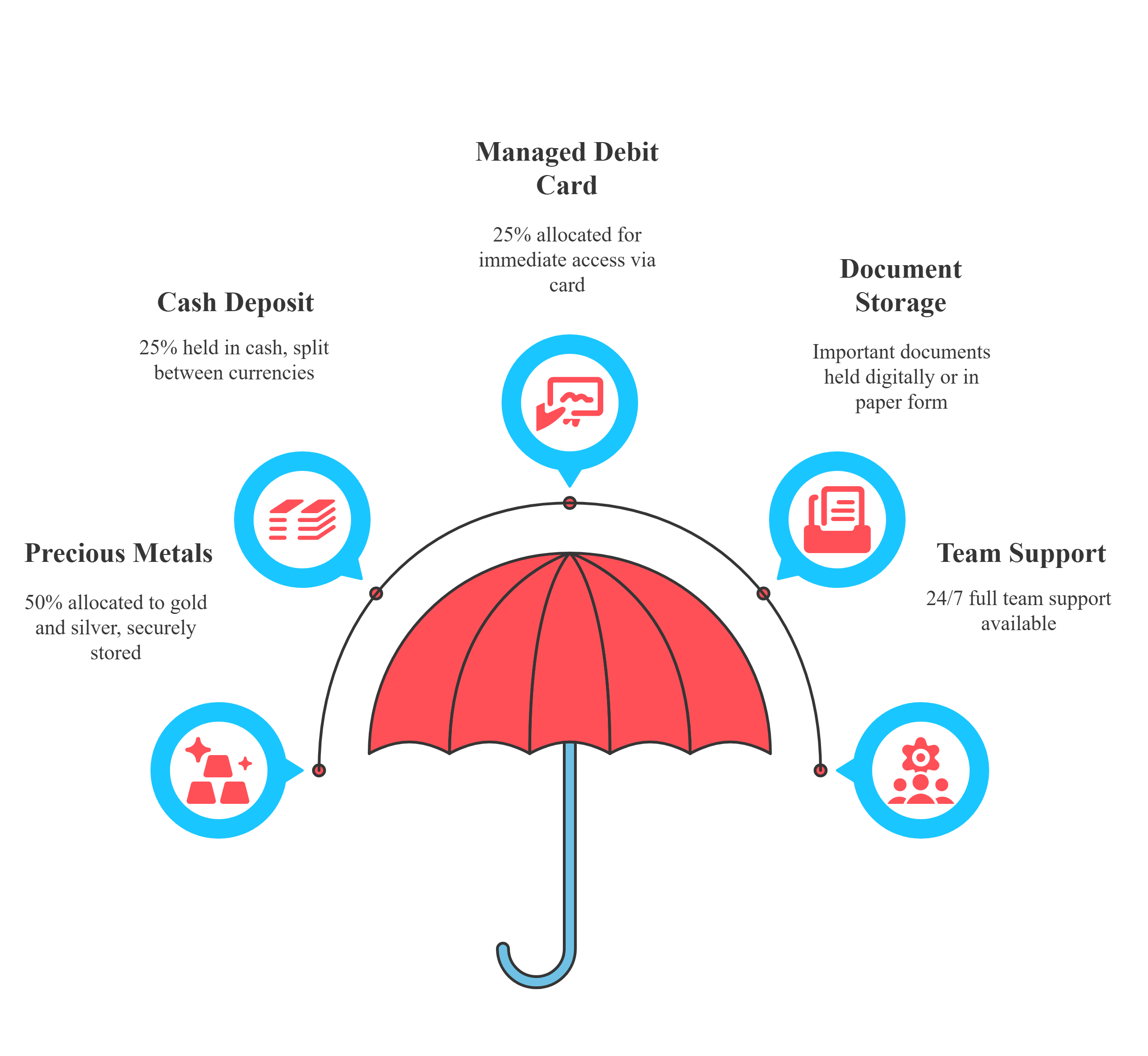

The Financial Go Plan (Formerly Pack) is a tailored financial safety net designed to ensure immediate liquidity, asset protection, and strategic support during emergencies. Whether it's a natural disaster, political unrest, or personal crisis, this plan ensures you’re prepared to act quickly and protect your financial stability.

With an Offshorezen Managed Go Plan cash is available immediately via card or transfer or MoneyGram. Gold held in storage can normally be sold and converted to cash with 2 hours during working hours.

For self managed go plans the international banking partnerships, funds can typically be accessed via card immediately. Either way ensuring you have immediate liquidity when it matters most.

Absolutely. In addition to ensuring liquidity, we provide crisis management support, relocation assistance, and access to a global network of experts, including legal and logistical specialists. We are By your side 24/7.

Yes, payments are flexible for example you may wish to start your plan around the $9,000 USD level for increased confidentiality.

It is really a question of control. With a managed plan the funds and assets sit under our segregated trusts, or in client Escrow. This means the assets are outside your estate and protected from the many risks discussed above. This benefit comes without cost to you.

With a managed plan you will set up offshore accounts directly in your name reducing the protection. You could setup offshore vehicles to add a layer of protection but at increased costs sometimes disproportionally high. Go Plans are designed to provide 3 months liquidity while you overcome a crisis. The size should reflect this. For longer term planning our Escape Plans and Offshore Plans are more appropriate.

Yes, payments are flexible for example you may wish to start your plan around the $9,000 USD level for increased confidentiality.

Yes. Each plan is tailored to align with your specific financial situation, risk tolerance, and goals. Normally you should plan for 3 months of liquidity. This number will vary client to client. The minimum Go Plan is USD$10,000, but this can be built up over a number of smaller payments if required.

We assess your unique circumstances to build a robust, personalized solution that's best for you. Some plans are a mixture of managed and self managed.

The Go Plan is designed for short term emergency preparedness, and forms part of an overall long term plan. The Escape Plans and Offshore Plans include components like tax optimization, asset protection, and investment strategies to secure and grow your wealth in the long term. During your Free meeting we will happily discuss your long term plans to see how we can help.

Contact us today, we will give you the best impartial advice.

Complete our Free meeting form, or give us a nudge on the live chat, Whatsapp or Telegram. Or contact us here.

Financial Go Plans and Escape plans are proactive and strategic approaches to preparing for unforeseen challenges, uncertainties, or emergencies. The specific reasons for needing them can vary depending on your individual circumstances.

An Offshore Plan is a combination of strategies that involves the use of Offshore Companies, Trusts, Offshore Banking and Visa or Immigration services. The aim is to legally reduce your taxes, protect your privacy and secure your assets. At the same time, save money and grow your assets through diversification.

All these strategies require more than one speciality and usually utilize the benefits of more than one jurisdiction and partners such as law firms, trustees and banks.

Our partners are chosen on merit as leaders in their field. We act on your behalf, always ensuring the best advice for you.

Asset Protection and Wealth Security have never been more important. Being prepared for any event to ensure you always have Financial liquidity and Freedom.

We would love to hear from you if you have any questions or need assistance. Contact us. Or chat with us on WhatsApp or Telegram now.

Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

Understanding these processes is essential for anyone seeking to manage and protect their wealth, as the lines between legitimate wealth...

At Offshorezen.com, we specialize in providing robust, rapid, and discreet offshore asset protection solutions designed to safeguard your financial future.

The top-tier jurisdictions have created legal environments that make it procedurally difficult and expensive for a creditor to pursue assets...

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.