In today’s unpredictable world, events ranging from geopolitical instability and economic shocks to natural disasters or personal crises can instantly jeopardise access to essential financial resources. Ensuring immediate liquidity becomes paramount for handling urgent needs like relocation or critical care. Furthermore, strategic asset protection through robust, international structures is crucial to counter threats such as localised banking failures or capital controls.

Our Escape Plan directly addresses these vulnerabilities, providing the preparedness necessary for decisive action and invaluable peace of mind.

The Escape Plan is designed for those clients who want a solid Plan B in place should the need arise. It’s a higher level of longer-term protection of assets and security. You may not have any intention of leaving your current country, but you want to be able to move on short notice should the need arise.

Having a solid financial escape plan is crucial for ensuring personal financial security in times of economic uncertainty or sudden life changes. This strategy acts as a safety net, providing our clients with the means to access resources during emergencies, such as economic downturns, job loss, or unforeseen expenses. It involves diversifying investments, maintaining liquid savings for immediate needs, and planning for long-term financial stability, allowing one to navigate financial crises with confidence.

Such planning not only safeguards one’s current lifestyle but also secures future financial well-being, enabling a smoother transition during turbulent times.

Most people should have a solid Financial Go Pack, and those with the financial means should combine this with a personalised Escape Plan known as a (Plan B).

Escape plans are a comprehensive approach that ensures not only the protection of your assets and income but also the security and well-being of your family. Each aspect of the plan should be tailored to your specific circumstances and reviewed regularly.

Investment Diversification: It’s crucial to spread investments across different asset classes like stocks, bonds, real estate, and possibly commodities or precious metals. This reduces risk since different assets react differently to market changes.

Legal Structures for Asset Protection: Using trusts, limited liability companies (LLCs), or family limited partnerships can help shield assets from legal judgments and creditors. For instance, an irrevocable trust can protect assets from both creditors and estate taxes.

Insurance for Asset Protection: This includes not just insuring physical assets like homes and cars, but also acquiring umbrella insurance policies that provide additional liability coverage beyond standard policies.

Emergency Fund: This should cover living expenses for a significant period (6 to 12 months) in case of job loss or other income disruptions. The fund should be easily accessible, like in a savings account.

Career and Income Diversification: Having skills in different areas or side businesses can create multiple income streams, making you less vulnerable to job loss in your primary field.

Passive Income Investments: Investments in dividend paying stocks, real estate investment trusts (REITs), or rental properties can provide ongoing income streams.

Estate Planning: A will, or trust ensures that your assets are distributed according to your wishes and can provide for your family’s needs. Trusts can also offer more control over how your assets are used after your death.

Education and Health Planning: Setting up college savings accounts (like 529 plans in the U.S.) and ensuring family members have adequate health insurance are key.

Life Insurance: This is critical, especially if you have dependents. Life insurance can replace your income for your dependents in case of your death.

Strategic Tax Planning: Utilize a variety of retirement account strategies that offer tax advantages. Long-term capital gains tax strategies and tax loss harvesting can also be beneficial.

Charitable Giving: Charitable donations can reduce taxable income. Strategies like donor advised funds or charitable remainder trusts can be part of your tax planning.

Having Backup Plans: It’s important to have plans for various emergency scenarios, including natural disasters, health crises, or economic downturns.

Document Management: Keep critical documents like insurance policies, wills, trusts, and investment records in a safe yet accessible location, and ensure someone you trust knows how to access them.

International banking plays a crucial role in an escape plan due to its ability to provide financial security, mobility, and anonymity across borders. In situations where individuals or businesses need to relocate or safeguard their assets quickly, international banking offers access to foreign accounts, currencies, and investment vehicles that can be critical for maintaining liquidity and freedom of movement. One of the key benefits of international banking is the diversification of assets. By holding funds in multiple jurisdictions, individuals can protect themselves from political or economic instability in their home country.

A second citizenship or second residency is a critical component of an escape plan because it provides individuals with an alternative place to live, work, and protect their assets in times of political, social, or economic instability. Having a second citizenship grants access to a new passport, which can be essential for travel freedom, especially if restrictions or sanctions are imposed on a primary country’s citizens. This allows for greater mobility and the ability to relocate quickly in the event of a crisis.

Moreover, second residency or citizenship often comes with the ability to access healthcare, education, and social benefits in another country, ensuring that individuals and their families are protected and supported in their new environment. It also provides access to new banking systems, investment opportunities, and legal protections, diversifying one’s financial base and reducing reliance on a single government.

Some offshore jurisdictions have more favourable regulatory environments for certain types of business activities, offering streamlined processes and reduced bureaucracy. This can be particularly advantageous for fintech companies, hedge funds, and insurance companies.

Solid offshore plans ensure that you are prepared for any eventuality. They include a solid Plan B It will include an actionable Financial Go Pack and Escape plan designed within your overall offshore plan.

In conclusion, both international banking and obtaining a second citizenship or residency are indispensable strategies in a well-planned escape plan. These tools not only provide financial and geographical flexibility but also offer safety nets in uncertain or unstable situations. International banking allows individuals to safeguard assets, access foreign markets, and maintain liquidity, all of which are essential for adapting to rapid changes in a home country’s political or economic climate. By diversifying assets across borders, people can protect their wealth from potential government interference, capital controls, or inflation.

Meanwhile, a second citizenship or residency grants legal rights to reside in another country, offering an escape route if conditions deteriorate at home. It opens doors to new opportunities, from visa-free travel to better healthcare, and can serve as a crucial refuge during times of crisis. With multiple legal residencies or citizenships, individuals are no longer dependent on one government for their security or livelihood.

Together, these strategies provide financial stability, mobility, and personal safety, which are crucial in ensuring freedom and protection when an immediate or long-term escape becomes necessary. In an unpredictable world, preparing for such eventualities is not just wise but often essential for survival. At OffshoreZen you can access expert advice all under one roof. Book a Free Meeting now to find out how we can help you.

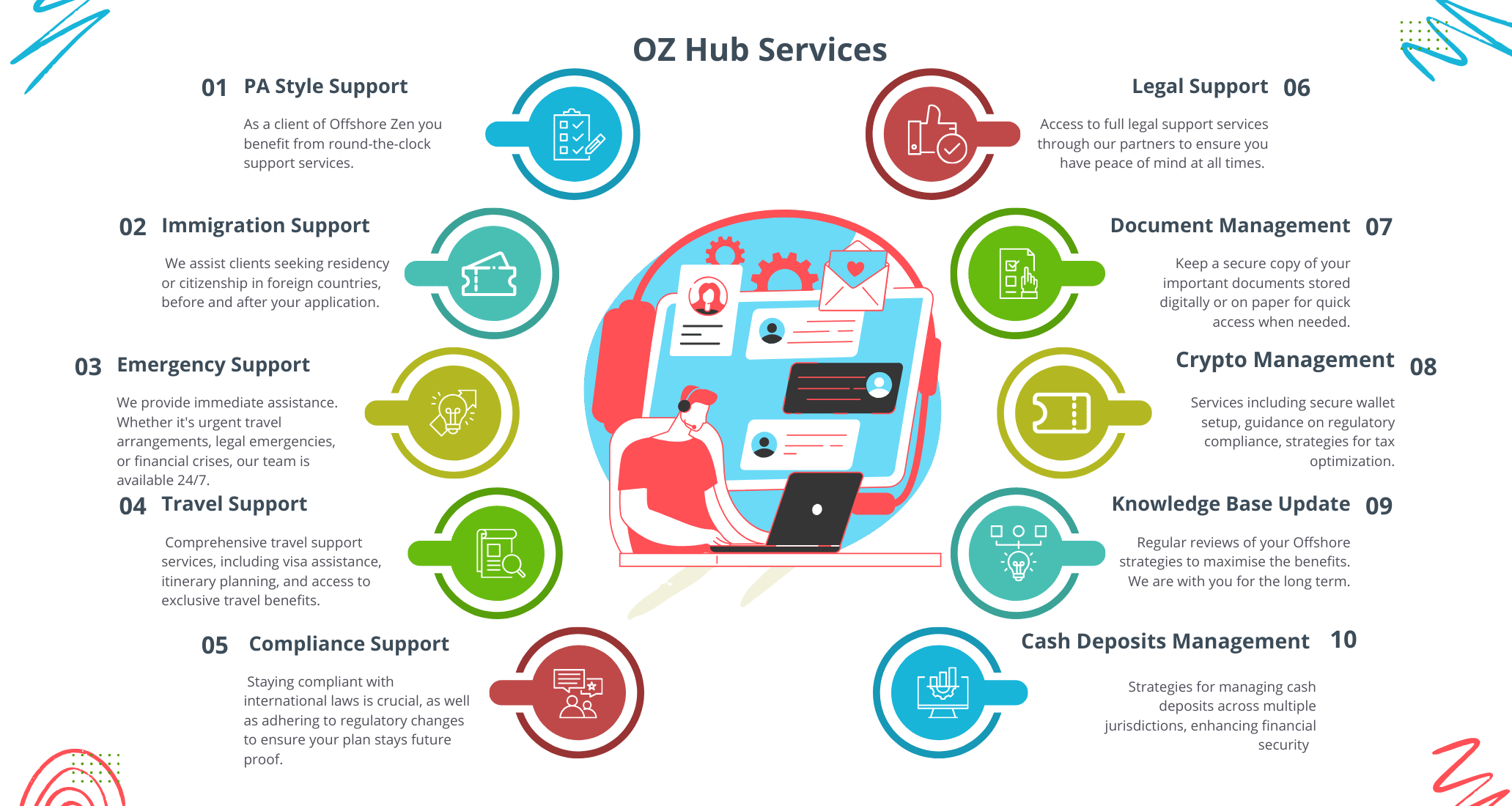

Our 24/7 client Hub service offers all of our clients support in normal day-to-day activities as well as in times of crisis.

As such, our growth is limited to ensure an ongoing high-value service for all our clients.

In today’s unpredictable world, events ranging from geopolitical instability and economic shocks to natural disasters or personal crises can instantly jeopardise access to essential financial resources.

It’s essential to have plans in place for various emergency scenarios, including natural disasters, health crises, or economic downturns. Your personal and financial security may depend on it.

The Escape Plan is designed for those clients who want a solid Plan B in place should the need arise. It’s a higher level of longer-term protection of assets and personal security. You perhaps have no intention of leaving your current country, but want to be able to move on short notice should the need arise.

Our 24/7 client Hub service offers all of our clients support in normal day-to-day activities as well as in times of crisis.

As such, our growth is limited to ensure an ongoing high-value service for all our clients.

Our client Hub offers Personalized Assistance, Full Crisis Support, Efficient Solutions, and time and cost savings. Delivered across timezones concierge style.

Finely tuned over the years to provide convenience and efficiency our Client Hub, will help you manage all your offshore requirements under one secure roof.

Accessible anytime, anywhere, our Client Hub ensures streamlined communication, real-time updates, and comprehensive oversight of your offshore ventures. At OffshoreZen.com, we are dedicated to delivering transparent, reliable, and client-centric services that empower you to thrive in the global marketplace.

With 24-hour concierge-style support services.

All Plans come with access to the full Hub services and 24-hour crisis support.

Our services are designed to meet the needs of a variety of clients. The huge benefits afforded by using offshore strategies can be expensive, and hence normally only worth while for wealthy investors and entrepreneurs. However, there are advantages and cost benefits for budding entrepreneurs and young investors. We design a plan to suit you and it will grow alongside your success.

We generally accept clients if we feel our services will be of benefit to them. Some of our wealthiest clients joined us two decades ago when they were just starting to build wealth. We have been with them helping them grow. There is NO minimum net worth but the benefits must outweigh the costs. We will be honest with you if we feel the costs will not be worthwhile for your situation. This is why we off a Free initial consult.

No we don't work like that. We need to get to know you, understand your current situation and future objectives. Then we can provide an outline of our ideas and costs. Prior to implementing your project we provide a full breakdown of costs and a fixed quote.

Cost varies depending on the level of service required. For example if all you require at this stage is an offshore company and bank account the costs could be a lows as $2,500. Depending on the type and location of the offshore company.

A $10k financial Go Plan costs $500 fixed for the full annual support service. The average Escape plan is around $8k but with second residence can rise considerably.

Our average retainer for a sophisticated offshore plan starts at $15k.

As you see prices vary depending on what you need.

Get in touch. It's that simple.

Complete our Free meeting form, or give us a nudge on the live chat, Whatsapp or Telegram.

Or contact us here.

We will be in touch and will be able to let you know very quickly how we can help. If we cannot help normally we can point you in the right direction

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.