An Offshore Plan is designed around your current situation and your objectives for the future.

Our team will help direct you, your business and family. We will make you aware of the opportunities available and guide you so that we can build a plan that is perfect for you now, and flexibile to adapt to future changes.

An Offshore Plan is designed around your current situation and your objectives for the future.

Our team will help direct you, your business and family. We will make you aware of the opportunities available and guide you so that we can build a plan that is perfect for you now, and flexibile to adapt to future changes.

Using offshore markets can offer various benefits, and can be a complicated process that should be well-researched and planned.

Individuals and corporations might seek a bespoke offshore financial plan for several reasons. The most popular are tax reduction, robust asset protection, global investment diversification, second citizenships, enhanced privacy, and tailored estate planning.

Such plans offer access to international markets and currency flexibility and may benefit from more favourable regulatory environments, facilitating expanding business operations and diversity in wealth management.

Whilst most people should have a Financial Go Pack, and those with the financial means should have a good Escape Plan (Plan B), a fully Bespoke Offshore Plan is not for everyone as the benefits must outweigh the costs. But don’t worry during the Free Initial meeting we will identify the best solutions for you.

Offshore strategies all come with some costs. We feel the costs should always be justified by the immediate and future benefits, such as tax savings and peace of mind knowing your assets cannot be taken from you.

You do not need to be super rich to benefit from our services, our strategies are holistic and built around your personal circumstances. Good offshore plans not only serve to reduce tax and protect assets. They can also help you grow your assets or business.

We help clients across a variety of net worths from young aspiring entrepreneurs to retired multi millionaires.

Creating a bespoke (personalised) offshore financial plan that caters to individual and business needs can be important for various reasons.

An effective strategy will use favourable jurisdictions that do not recognise the judgments passed in your home country. These locations have regulations that favour strong asset protection and confidentiality.

Here are 10 key elements of offshore planning:

One of the primary reasons individuals and corporations opt for offshore financial planning is to benefit from lower tax jurisdictions. Offshore financial centres often offer tax incentives that can significantly reduce tax liabilities. A bespoke plan can help in legally minimizing tax obligations through the efficient structuring of investments and income.

Offshore financial plans can offer robust asset protection features against lawsuits, creditors, or other claims. By placing assets in jurisdictions with strong privacy laws and asset protection statutes, individuals can safeguard their wealth more effectively than they might be able to domestically.

Many offshore jurisdictions offer enhanced privacy and confidentiality for investors. For those concerned about the privacy of their financial affairs, a bespoke offshore plan can provide a legal avenue to maintain anonymity to a certain extent.

A bespoke offshore financial plan allows for global investment diversification, reducing the risk associated with having all assets in one country or in a single currency. This can be particularly important for individuals living in countries with unstable economies or currencies.

Offshore structures, such as trusts and foundations, can be tailored to specific family needs, providing for efficient and private transfer of wealth to future generations. This can include stipulations on how assets are to be distributed, thus avoiding the complexities and public scrutiny of probate in the individual’s home country.

Offshore financial centres often provide investors with access to international markets and top-tier investment opportunities not available in their home country. This can include exclusive funds, commodities, and other investment vehicles.

Operating in an offshore financial centre allows for transactions in multiple currencies, providing a hedge against currency devaluation in the investor’s home country and facilitating easier international trade for businesses.

In an increasingly interconnected world, the idea of having a second residence has become not just a luxury but a strategic decision for many individuals. Whether driven by business, lifestyle, or personal reasons, having a second citizenship or residency offers a myriad of benefits, from enhanced global mobility to diversification of assets.

Some offshore jurisdictions have more favourable regulatory environments for certain types of business activities, offering streamlined processes and reduced bureaucracy. This can be particularly advantageous for fintech companies, hedge funds, and insurance companies.

Solid offshore plans ensure that you are prepared for any eventuality. They include a solid Plan B It will include an actionable Financial Go Pack and Escape plan designed within your overall offshore plan.

A bespoke offshore financial plan needs to be carefully designed, taking into account the individual’s or business’s financial goals, risk tolerance, and the legal and regulatory implications in both the home country and the offshore jurisdiction. Due to the complexity and potential legal and ethical implications of offshore financial planning, it’s advisable to seek expert advice from financial advisors, tax consultants, and legal professionals specializing in this field. At OffshoreZen you can access expert advice all under one roof. Book a Free Meeting now to find out how we can help you.

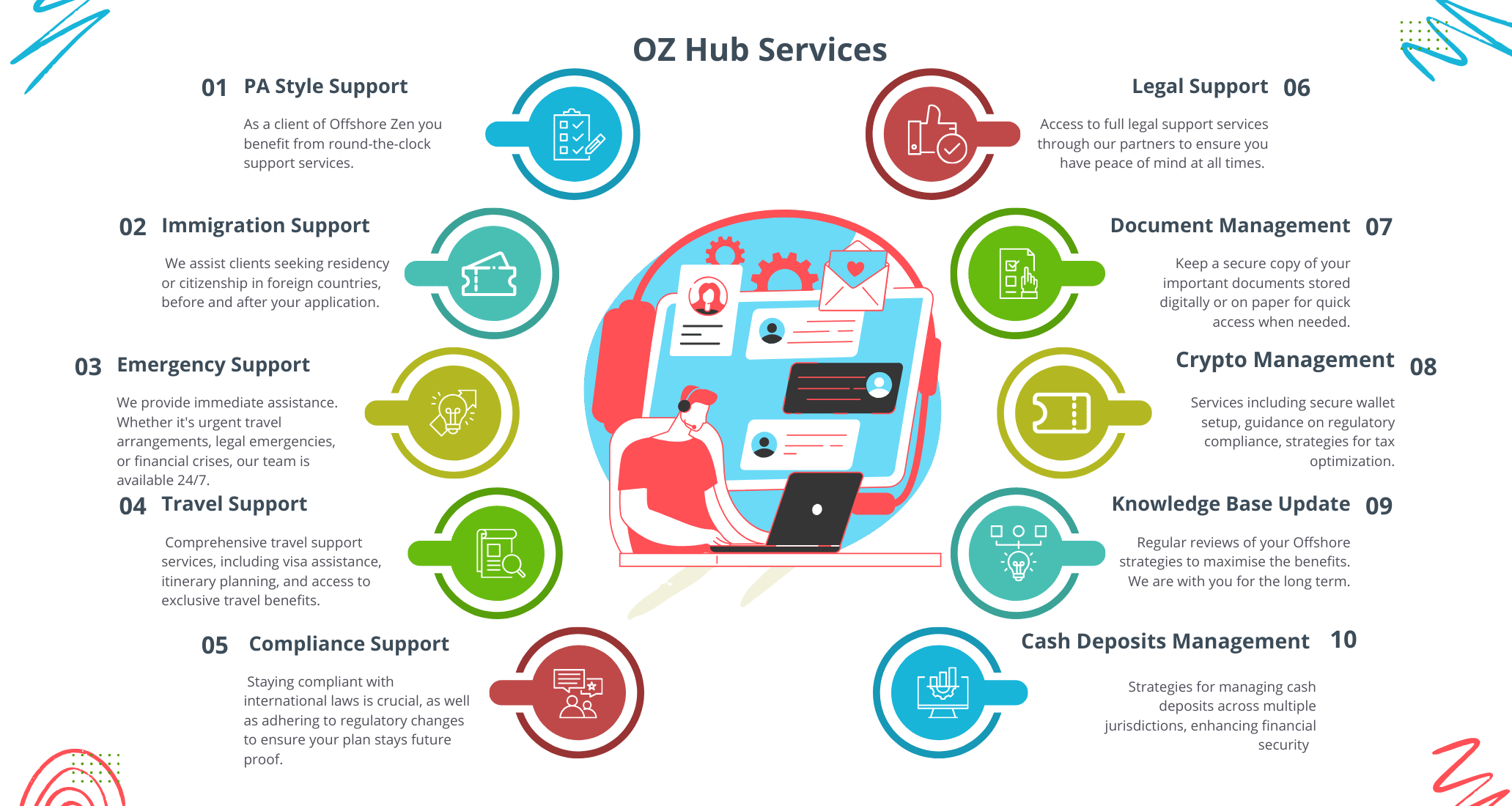

Our 24/7 client Hub service offers all of our clients support in normal day-to-day activities as well as in times of crisis.

As such, our growth is limited to ensure an ongoing high-value service for all our clients.

Whilst most people should have a Financial Go Pack, and those with the financial means should have a good Escape Plan (Plan B), a fully Bespoke Offshore Plan is not for everyone, as the benefits must outweigh the costs. But don’t worry, during the Free Initial meeting, we will identify the best solutions for you.

Our client Hub offers Personalized Assistance, Full Crisis Support, Efficient Solutions, and time and cost savings. Delivered across timezones concierge style.

Finely tuned over the years to provide convenience and efficiency our Client Hub, will help you manage all your offshore requirements under one secure roof.

Accessible anytime, anywhere, our Client Hub ensures streamlined communication, real-time updates, and comprehensive oversight of your offshore ventures. At OffshoreZen.com, we are dedicated to delivering transparent, reliable, and client-centric services that empower you to thrive in the global marketplace.

With 24-hour concierge-style support services.

All Plans come with access to the full Hub services and 24-hour crisis support.

Our services are designed to meet the needs of a variety of clients. The huge benefits afforded by using offshore strategies can be expensive, and hence normally only worth while for wealthy investors and entrepreneurs. However, there are advantages and cost benefits for budding entrepreneurs and young investors. We design a plan to suit you and it will grow alongside your success.

We generally accept clients if we feel our services will be of benefit to them. Some of our wealthiest clients joined us two decades ago when they were just starting to build wealth. We have been with them helping them grow. There is NO minimum net worth but the benefits must outweigh the costs. We will be honest with you if we feel the costs will not be worthwhile for your situation. This is why we off a Free initial consult.

No we don't work like that. We need to get to know you, understand your current situation and future objectives. Then we can provide an outline of our ideas and costs. Prior to implementing your project we provide a full breakdown of costs and a fixed quote.

Cost varies depending on the level of service required. For example if all you require at this stage is an offshore company and bank account the costs could be a lows as $2,500. Depending on the type and location of the offshore company.

A $10k financial Go Plan costs $500 fixed for the full annual support service. The average Escape plan is around $8k but with second residence can rise considerably.

Our average retainer for a sophisticated offshore plan starts at $15k.

As you see prices vary depending on what you need.

Get in touch. It's that simple.

Complete our Free meeting form, or give us a nudge on the live chat, Whatsapp or Telegram.

Or contact us here.

We will be in touch and will be able to let you know very quickly how we can help. If we cannot help normally we can point you in the right direction

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.