Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

The European Union has a robust and evolving legal framework aimed at combating organized crime and terrorist financing by ensuring the efficient freezing and confiscation of assets across member states. This framework is a direct response to the sophisticated methods criminals use to move and hide illicit funds across international borders. Understanding these processes is essential for anyone seeking to manage and protect their wealth, as the lines between legitimate wealth preservation and illegal asset hiding can be complex.

EU Asset Freezing and Confiscation Processes

The EU’s approach to asset recovery is built on the principle of mutual recognition, a cornerstone of judicial cooperation within the union. This principle, primarily governed by Regulation (EU) 2018/1805, means that a freezing or confiscation order issued by a court in one member state must generally be recognized and enforced by all other member states. This regulation was designed to dismantle legal and administrative barriers, ensuring that criminals cannot simply move their assets to another EU country to escape legal action.

The process is streamlined through standardized certificates and strict deadlines. For instance, a freezing order, which is a temporary measure to prevent assets from being moved or disposed of, must be executed within 48 hours of being received by the enforcing authority. A confiscation order, which permanently deprives a person of their assets, has a 45-day deadline for execution. These tight timelines are intended to prevent asset flight and make the system more effective.

In addition to this regulation, the European Commission has proposed a new Directive on Asset Recovery and Confiscation. This directive aims to further strengthen the EU’s hand by allowing for non-conviction-based confiscation, where assets can be seized even without a criminal conviction if they are proven to be linked to criminal activities. It also introduces the concept of confiscating “unexplained wealth” and requires member states to establish specialized Asset Management Offices to handle seized assets. The goal is to make it harder for criminals to profit from their illegal activities and to ensure that the proceeds of crime are not only recovered but also used for public benefit or victim compensation.

These policies are a clear signal that the EU is committed to making its internal market a hostile environment for illicit wealth. They create a legal landscape where assets are highly vulnerable to seizure if they are linked to any form of criminal activity, regardless of where they are located within the EU.

The Legal Use of Offshore Trusts for Asset Protection

In this environment of enhanced scrutiny and cross-border cooperation, individuals with significant assets often turn to legal strategies for asset protection. One of the most powerful and widely used tools is the offshore trust. An offshore trust is a legal arrangement where assets are transferred from the owner (settlor) to a professional third party (trustee) in a foreign jurisdiction. The trustee then holds and manages these assets for the benefit of designated individuals (beneficiaries). The key legal principle here is the separation of legal ownership (held by the trustee) from beneficial ownership (held by the beneficiaries). This separation is the foundation of an effective asset protection strategy.

Offshore trusts are not inherently illegal and are used for various legitimate purposes, including estate planning, inheritance tax minimization, and wealth preservation. The term “offshore” simply refers to the jurisdiction where the trust is established. Many jurisdictions, particularly those in the Caribbean and other financial centres, have developed sophisticated legal frameworks that offer strong asset protection features.

A primary advantage of these trusts is that they place assets outside the direct jurisdiction of a settlor’s home country. This means that a court in the settlor’s country may not have the authority to compel the foreign trustee to hand over the trust’s assets. In many offshore jurisdictions, a foreign judgment is not automatically recognized. A creditor seeking to seize assets held in an offshore trust must often re-litigate the entire case in the trust’s jurisdiction, a process that is typically very expensive, time-consuming, and governed by legal standards that are highly favourable to the trust.

For example, jurisdictions like the Cook Islands and Nevis have specific laws that make it exceptionally difficult for foreign creditors to successfully challenge a trust.

These laws often include:

These legal barriers create a significant deterrent for creditors, making offshore trusts a powerful tool for asset protection.

While specific examples of individuals are not publicly available due to privacy laws, the legal history of offshore trusts is full of cases that illustrate their resilience and the challenges they present to legal systems. European courts, including the European Court of Justice (ECJ), have grappled with how to define and enforce judgments in a way that can pierce the veil of these offshore structures.

For instance, cases before the ECJ have focused on the interpretation of what constitutes a “judgment” that must be recognized across member states. The legal debate has centred on whether a judgment against a settlor can be enforced against an offshore trust where the trustee and assets are located outside the EU. The ECJ has affirmed that while the principle of mutual recognition is broad, it is not absolute. The laws of the offshore jurisdiction, which are sovereign, often take precedence in such matters.

Furthermore, offshore jurisdictions themselves have evolved their laws in response to these legal challenges. For example, some jurisdictions have introduced “flight clauses” that allow a trustee to move the trust’s domicile to another, even more protective, jurisdiction if a legal challenge arises. The goal of this continuous legal development is to maintain the jurisdiction’s status as a secure location for wealth management.

The legal strategy of using offshore trusts is to position assets in a jurisdiction with laws that do not recognize foreign judgments, forcing any claimant to re-file their case in that jurisdiction and meet a much higher burden of proof. This process, known as the “charging order” defence, is often sufficient to protect assets from a creditor’s reach, as the costs and legal hurdles are often insurmountable.

It is crucial to note that the effectiveness of an offshore trust depends entirely on the legality and timing of its creation. If a trust is established after a legal claim has already been made, it could be deemed a fraudulent conveyance, and a court might order the assets returned. Therefore, these structures must be established well in advance of any potential legal threat and with full compliance with all relevant laws, including tax reporting requirements in the settlor’s home country.

The EU has established a strong and interconnected legal system to combat financial crime and ensure that illegal assets are frozen and confiscated efficiently. This system has fundamentally changed the landscape of cross-border asset recovery, making it increasingly difficult for criminals to hide their wealth within the Union.

In response, legal professionals and their clients have developed sophisticated, legitimate strategies to protect assets. Offshore trusts, when established correctly and with sound legal advice, offer a powerful method for asset preservation by leveraging the sovereignty of foreign legal systems. They are not a tool for illegal activity but rather a means to legally separate and protect assets from unpredictable legal risks, a fact supported by their long history of being tested and refined in courts worldwide.

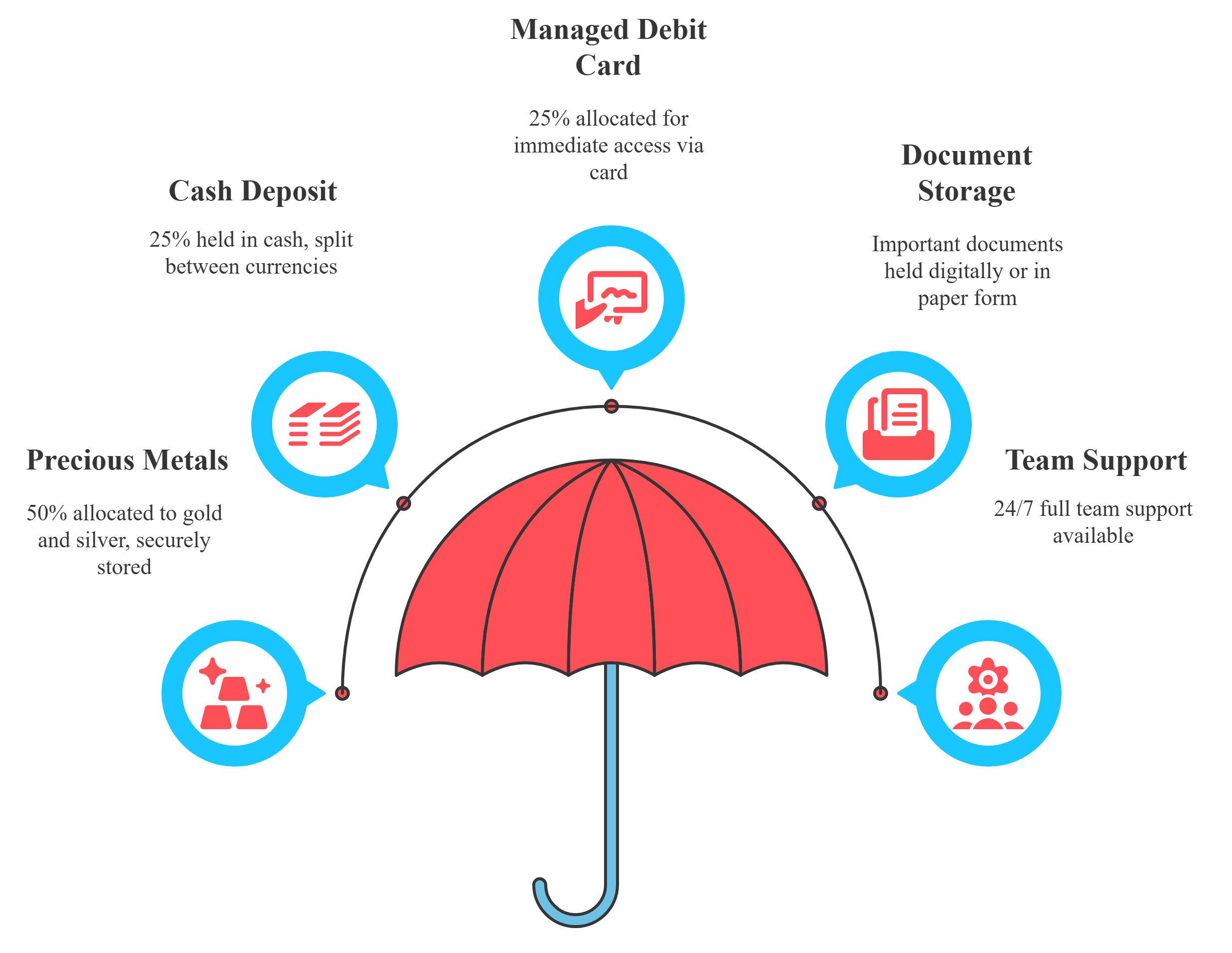

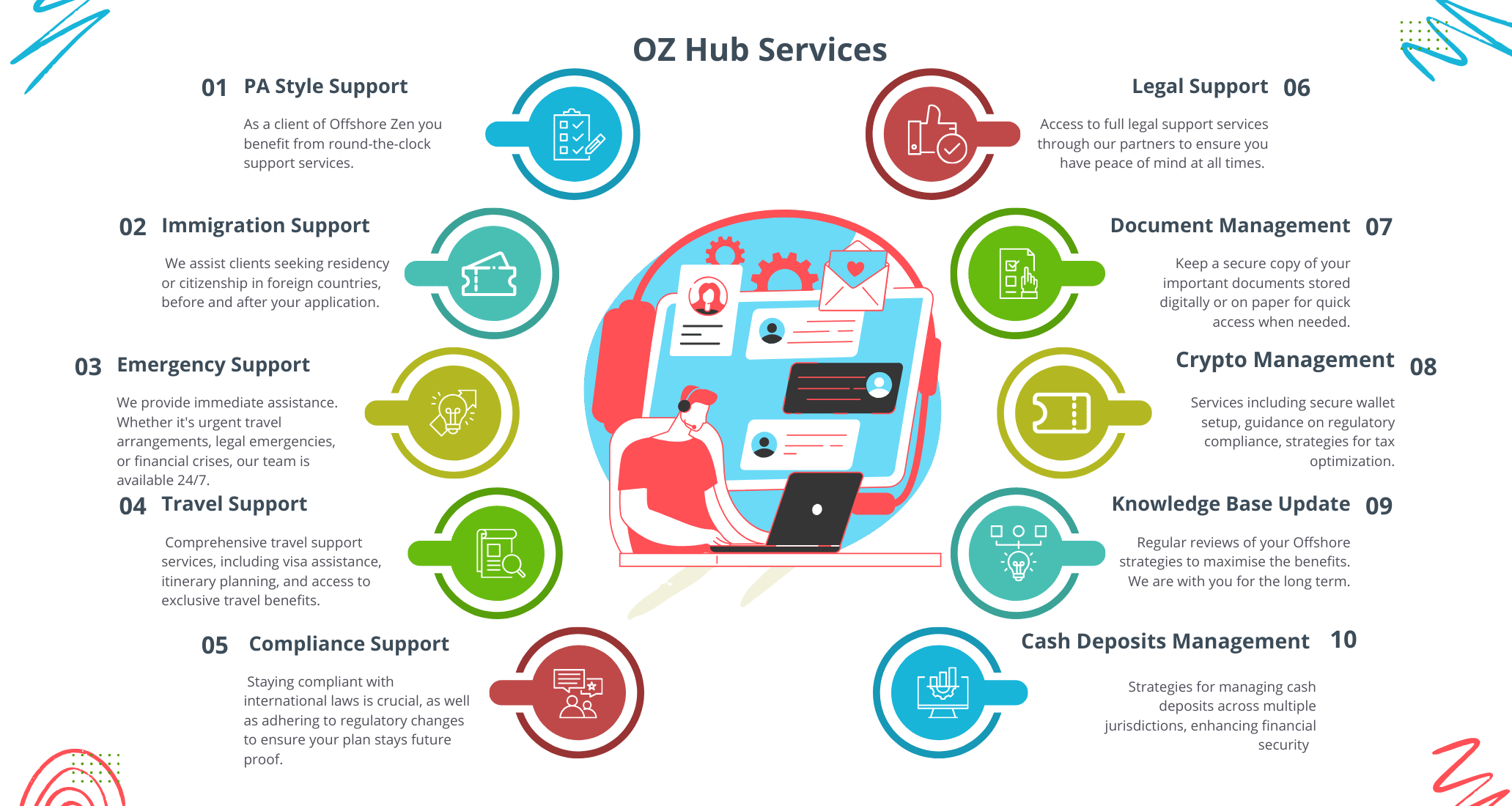

When markets shift and global systems get shaky, you need a reliable partner who’s ready around the clock. Offshore Zen’s 24/7 Hub services deliver real-time support, helping you act swiftly and smartly. Whether you’re buying gold as a hedge, managing international assets, or building a nest egg overseas, we provide the tools and expert guidance you need to stay one step ahead.

Whether you’re an entrepreneur, investor, or expatriate, Offshore Zen equips you with the peace of mind, freedom, and flexibility to operate confidently no matter where life takes you. Don’t wait for the next emergency to plan ahead.

Let’s talk now and prepare a Financial Go Plan that truly protects what matters.

Financial Go Plans and Escape plans are proactive and strategic approaches to preparing for unforeseen challenges, uncertainties, or emergencies. The specific reasons for needing them can vary depending on your individual circumstances.

An Offshore Plan is a combination of strategies that involves the use of Offshore Companies, Trusts, Offshore Banking and Visa or Immigration services. The aim is to legally reduce your taxes, protect your privacy and secure your assets. At the same time, save money and grow your assets through diversification.

All these strategies require more than one speciality and usually utilize the benefits of more than one jurisdiction and partners such as law firms, trustees and banks.

Our partners are chosen on merit as leaders in their field. We act on your behalf, always ensuring the best advice for you.

Asset Protection and Wealth Security have never been more important. Being prepared for any event to ensure you always have Financial liquidity and Freedom.

We would love to hear from you if you have any questions or need assistance. Contact us. Or chat with us on WhatsApp or Telegram now.

Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

Understanding these processes is essential for anyone seeking to manage and protect their wealth, as the lines between legitimate wealth...

At Offshorezen.com, we specialize in providing robust, rapid, and discreet offshore asset protection solutions designed to safeguard your financial future.

The top-tier jurisdictions have created legal environments that make it procedurally difficult and expensive for a creditor to pursue assets...

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.