Residency by investment programmes often referred to as Golden Visas offer individuals and families the opportunity to live, work, and enjoy the benefits of a new country while diversifying their global footprint. This pathway combines financial investment with access to superior healthcare, education, and lifestyle, ensuring financial and travel freedoms. Most of these permanent residency programs cater to high-net-worth clients looking for a second or permanent residency and a possible pathway to citizenship

OffshoreZen offers our clients and their families the option of obtaining a second residency via our Escape Plan or Offshore Plan Packages. This holistic approach serves to maximise benefits such as tax reduction, and asset protection. We specialize in guiding clients through this transformative process, ensuring compliance, efficiency, and tailored solutions to match your goals and ensure your security and financial freedom.

A Contingency Plan for an Uncertain World

In a rapidly evolving global landscape, residency by investment serves as a vital contingency plan, ensuring security for your family and assets. It provides access to politically stable countries with robust legal systems, offering a safe haven during times of upheaval. By diversifying your presence in economically resilient nations, you can protect your wealth against the uncertainties of volatile markets.

Furthermore, residency in countries with advanced healthcare systems ensures immediate access to world-class medical care during health crises or pandemics. This strategic planning empowers you to navigate unforeseen challenges with confidence.

Summary

Access to Superior Healthcare

Residency in nations with advanced healthcare systems provides families with unparalleled medical care. From state-of-the-art hospitals to specialized treatments and preventive services, residents gain access to world-class health facilities. Many programs also include access to national healthcare systems, which are often free or highly subsidized. This ensures that families can manage chronic conditions, handle medical emergencies, and receive preventive care without undue financial burden. For example, European countries like Portugal or Spain provide highly ranked healthcare services, while Caribbean programs offer proximity to excellent medical facilities in North America.

Facilitating International Business Expansion

Residency by Investment unlocks new opportunities for entrepreneurs and investors seeking to expand their global reach. By obtaining residency in key economic zones, individuals can establish a foothold in strategic markets, facilitating seamless international operations. This status often simplifies cross-border travel, expediting business dealings and partnerships. Many programs also offer tax benefits, allowing businesses to optimize their financial structures. Residency in economically dynamic regions opens doors to extensive networks, enabling connections with investors, partners, and innovation hubs, which are critical for driving growth. Additionally, businesses can tap into skilled labour markets and innovation ecosystems in their new host countries, further enhancing operational efficiency.

Access to Superior Healthcare

Residency in nations with advanced healthcare systems provides families with unparalleled medical care. From state-of-the-art hospitals to specialized treatments and preventive services, residents gain access to world-class health facilities. Many programs also include access to national healthcare systems, which are often free or highly subsidized. This ensures that families can manage chronic conditions, handle medical emergencies, and receive preventive care without undue financial burden. For example, European countries like Portugal or Spain provide highly ranked healthcare services, while Caribbean programs offer proximity to excellent medical facilities in North America.

High-Quality Education for Future Generations

Residency by Investment opens doors to premier educational opportunities for children and young adults. Residents can access world-class public and private schools and renowned universities, ensuring their children receive top-tier education. For many families, residency also significantly reduces tuition fees compared to those charged to international students. Beyond academics, living in diverse cultural environments fosters language acquisition, global awareness, and adaptability—critical skills for thriving in a globalized world. Residency often serves as a pathway to citizenship, enabling future generations to secure long-term benefits such as full access to host-country educational resources and professional opportunities.

Future-Proofing Wealth and Investments

Residency by Investment often ties directly to strategic investments that yield both financial and personal rewards. Many programs require investments in real estate or government funds, offering opportunities to generate income or long-term returns. This approach diversifies portfolios, mitigates risk, and ensures wealth preservation in stable economic climates. Additionally, the residency allows families to establish generational wealth structures, securing legacies and providing seamless wealth transfer to heirs.

Residency by Investment is a transformative step toward securing your family’s future, expanding business horizons, and enhancing quality of life. It invests in stability, growth, and opportunity, tailored to meet your unique goals and aspirations.

Contact us today for a free meeting to explore how Residency by Investment can help you achieve your global ambitions.

Government Contribution or Donation

Government contributions are typically non-refundable donations made to a national development fund or similar government initiative. This is one of the most straightforward options under many Golden Visa programmes, including those in countries like Antigua and Barbuda. They requite a USD$100k (donation) or $400k in real estate.

The contribution amount varies depending on the country and the number of dependents included in the application.

This option is attractive because it offers a fast and simple route to permanent residency, with no obligation for the applicant to maintain real estate or business ownership. The funds are used to drive economic development, enhance infrastructure, or support social welfare programs, providing long-term benefits to the country.

While it may not involve physical assets like real estate, this type of donation ensures a relatively quick and cost-effective process. For those who prefer not to deal with ongoing property management or business ventures, government contributions are often the most efficient route to obtaining a second residency or citizenship.

Real Estate Investment

Real estate investment is a popular option under various Golden Visa programmes, allowing applicants to acquire property in the host country as part of their application. This option requires purchasing government-approved real estate, often located in designated development zones. Real estate investments typically require higher minimum investments compared to government donations, with prices often starting at $250,000 or more.

In many programs, the applicant must hold the property for a specific period usually 5 years before it can be sold, ensuring the investment provides long-term economic benefits to the country. This option offers the added benefit of tangible assets, as the real estate can appreciate over time, providing potential financial returns in addition to citizenship.

Business Investment

Business investments involve the creation of a business entity or a significant investment in an existing business, typically aimed at fostering economic growth in the host country. This option is generally available in most countries. The minimum investment amount varies by country but typically starts at several hundred thousand dollars, with the funds intended to create jobs or stimulate local industries.

This type of investment allows applicants to contribute to the local economy while potentially benefiting from business opportunities. Investors must often provide a detailed business plan demonstrating how their venture will create employment opportunities and promote local development. In some cases, the business may need to be fully operational within a specified time frame to ensure the sustainability of the investment.

Residency by investment (Golden Visa) programs allow individuals to secure legal residence in a country by making a significant financial contribution to its economy. While specific requirements vary across countries, the following are common elements typically involved:

Financial Investment

The cornerstone of RBI programs is the financial contribution, which can include:

Clean Criminal Record

Applicants must demonstrate a clean legal history, typically verified through police clearance certificates from their home country and any other country of residence.

Proof of Funds

Applicants must prove the legality of the funds they intend to invest. This includes:

While some programs have no minimum residency requirements (e.g., Greece), others may require short stays, such as 7 days per year for Portugal’s Golden Visa.

Health Insurance

Many programs require proof of health insurance covering the applicant and their dependents during the residency period.

Age and Dependents

Applicants must typically be over 18 years old. They can include dependents such as:

Application Process and Fees

Residency Conditions

Depending on the program, additional conditions may apply:

Documentation

Standard documentation includes:

Language and Cultural Knowledge

While rare for residency programs, some countries require language or cultural integration tests, more common in citizenship-by-investment programs.

Minimum Investment: €250,000–€500,000 (e.g., venture funds, urban regeneration projects).

Processing Time: 6–12 months.

Benefits: Minimal stay requirements, pathway to citizenship after 5 years, visa-free Schengen Zone travel, and access to healthcare and education.

Minimum Investment: €500,000 (real estate).

Processing Time: 2–6 months.

Benefits: EU residency, visa-free travel within Schengen Zone, no physical residency required.

Minimum Investment: €500,000 (real estate.

Processing Time: ~2 months.

Benefits: Visa-free Schengen travel, pathway to permanent residency or citizenship, no stay requirement.

Minimum Investment: €250,000–€2 million (startups, government bonds, or philanthropic contributions).

Processing Time: 3–6 months.

Benefits: Residency with access to Italy’s healthcare and education systems, eligibility for permanent residency or citizenship, and Schengen Zone travel.

Minimum Investment: €250,000 (real estate or bank deposit).

Processing Time: ~3 months.

Benefits: Schengen Zone access, no residency requirement, and pathway to citizenship after 10 years.

Minimum Investment: Program currently paused; formerly €250,000 (bonds).

Processing Time: ~3 months (when active).

Benefits: EU residency, visa-free Schengen Zone travel, and an affordable program (pending resumption).

Minimum Investment: £2 million (UK businesses or government bonds).

Processing Time: ~3 months.

Benefits: Access to the UK’s education and healthcare systems, a pathway to settlement after 5 years, and a route to citizenship after 6 years.

Minimum Investment: $150,000 (donation) or $200,000 (real estate).

Processing Time: 60–90 days.

Benefits: Direct citizenship, visa-free access to 153 countries, no residency requirement.

Minimum Investment: €300,000 (real estate, business, or investment fund).

Processing Time: ~2 months.

Benefits: Permanent residency, tax advantages, and eligibility for citizenship after 5 years.

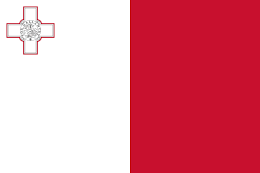

Minimum Investment: €600,000 (donation) + real estate lease or purchase.

Processing Time: 12–18 months.

Benefits: EU residency, healthcare access, and fast-track citizenship option.

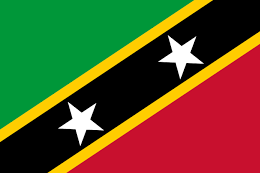

Minimum Investment: $100,000 (donation) or $400,000 (real estate).

Processing Time: 3–6 months.

Benefits: Citizenship with visa-free access to 150 countries.

Minimum Investment: AED 2 million (~$545,000; real estate).

Processing Time: ~2 months.

Benefits: Long-term residency (10 years), no personal income tax, and access to global business hubs.

Residency by Investment (Golden Visa) offers individuals and families an unparalleled opportunity to enhance their global mobility, secure a stable future, and gain access to better healthcare, education, and business opportunities. It serves as a contingency plan for economic or political uncertainty, allowing investors to diversify their assets and achieve personal and professional growth in countries with robust infrastructures and democratic stability.

The advantages are numerous. Families can enjoy world-class living standards, safety, and the ability to travel visa-free across various regions. For entrepreneurs and investors, these programs provide access to thriving global markets, tax incentives, and proximity to skilled labour pools. Residency often leads to eventual citizenship, creating a legacy of opportunities for future generations.

However, residency by investment is not without its downsides. The financial commitments are substantial, and in some cases, the investments may not yield significant returns. Some programs also have long processing times, and not all provide immediate access to permanent residency or citizenship. Additionally, applicants must navigate stringent due diligence and compliance procedures, which require expert guidance. For those with more transient needs, the residency obligations (where applicable) can pose logistical challenges.

Ultimately, Residency by Investment and Golden Visa programmes are transformative tools for global citizens. They combine financial investment with a pathway to enhanced freedom, security, and opportunities. To ensure the best outcome, prospective applicants should carefully evaluate their priorities, conduct thorough research, and seek professional advice tailored to their unique goals.

If you’re ready to explore your options or have questions about finding the right program, contact us today to take the first step toward securing your global future. We can chat on WhatsApp or Telegram

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.