Our strategies are holistic and built around your personal circumstances.

Our strategies are holistic and built around your personal circumstances.

Ensure immediate access to essential funds during financial turmoil, legal threats, natural disasters, or political instability. Don’t get caught unprepared.

The Financial Go Pack is designed to provide our clients with liquidity and support in times of severe crisis. This crisis can come in many forms.

If you have the resources to hand, then a sound go pack is a very sensible part of your overall planning. The aim would be to have enough liquidity to survive at least 1 to 3 months without access to any other assets. We suggest a minimum of $10k; most plans average between $30 $60k.

| Pros | Cons |

| Rapid Setup: Accounts and asset allocation can be established very quickly, often within 24 hours. | Less Direct Control: You do not directly manage the underlying bank, bullion, or card accounts; Offshore Zen handles this. |

| High Convenience & Value: Requires minimal effort from you; Offshore Zen manages the entire structure and asset allocation. You save on fees and buying costs. Worth 3 to 5% in savings. | Ongoing Annual Fee: There is an annual management fee (e.g., $300 USD with Offshore Zen), although this may often be covered by interest earned on cash deposits. |

| Enhanced Asset Protection: Assets are held within a managed structure, offering a higher degree of shielding from personal litigation or asset freezes compared to accounts held directly in your name. | For smaller amounts: Generally recommended for Plans valued below $50,000, in essential emergency funds. |

| Ideal for Essential Emergency Funds: Perfect for quickly securing a liquid emergency fund without the complexities of setting up individual offshore entities. | Predetermined Asset Allocation: While strategically diversified (e.g., 50% gold, 25% foreign currency, 25% card), there’s less flexibility for you to dictate custom allocations compared to a self-managed plan. |

| Full Access to Hub Concierge Services: Includes 24/7 crisis support for travel, legal, logistics, secure document storage, and emergency assistance. | |

| Professional Management: Assets are managed by experts who understand offshore structuring and crisis preparedness. |

| Pros | Cons |

| Direct Control & Ownership: You have full personal control over your offshore bank, bullion, and card accounts. | Slower Setup Time: Establishing offshore companies (if used) and individual accounts can take up to 3 months or more. |

| Flexibility in Choices: You can choose specific banks, bullion dealers, and card providers (with guidance from Offshore Zen). | Higher Client Involvement: Requires more of your time, effort, and understanding to manage the accounts and any associated company structures. |

| Potentially More Cost-Effective for Larger Sums (Long-Term): The one-time setup fee may be more economical than ongoing management fees if you are safeguarding a significant amount for an extended period. | Higher Initial Setup Cost: Involves an upfront fee (e.g., $1200 USD with Offshore Zen) to cover assistance with company formation, bank introductions, etc. |

| Transparency: You have direct visibility into all account activities and holdings. | Asset Risk (if held directly in personal name): Assets held directly in your personal name offshore, while providing separation from your home country, may still be more susceptible to freezes or legal actions targeting you personally compared to assets in a managed structure or a well-structured offshore company. |

| Full Access to Hub Concierge Services: Clients still benefit from 24/7 crisis support for travel, legal, logistics, etc. | Complexity: Setting up and managing offshore entities and accounts can be complex, requiring careful attention to legal and compliance requirements. |

| Customizable Structure: Can be tailored precisely to your needs, especially when using an offshore company structure for enhanced asset protection. | Ongoing Maintenance (for company structures): If an offshore company is used, there will be ongoing maintenance, filing requirements, and potential costs associated with that entity. |

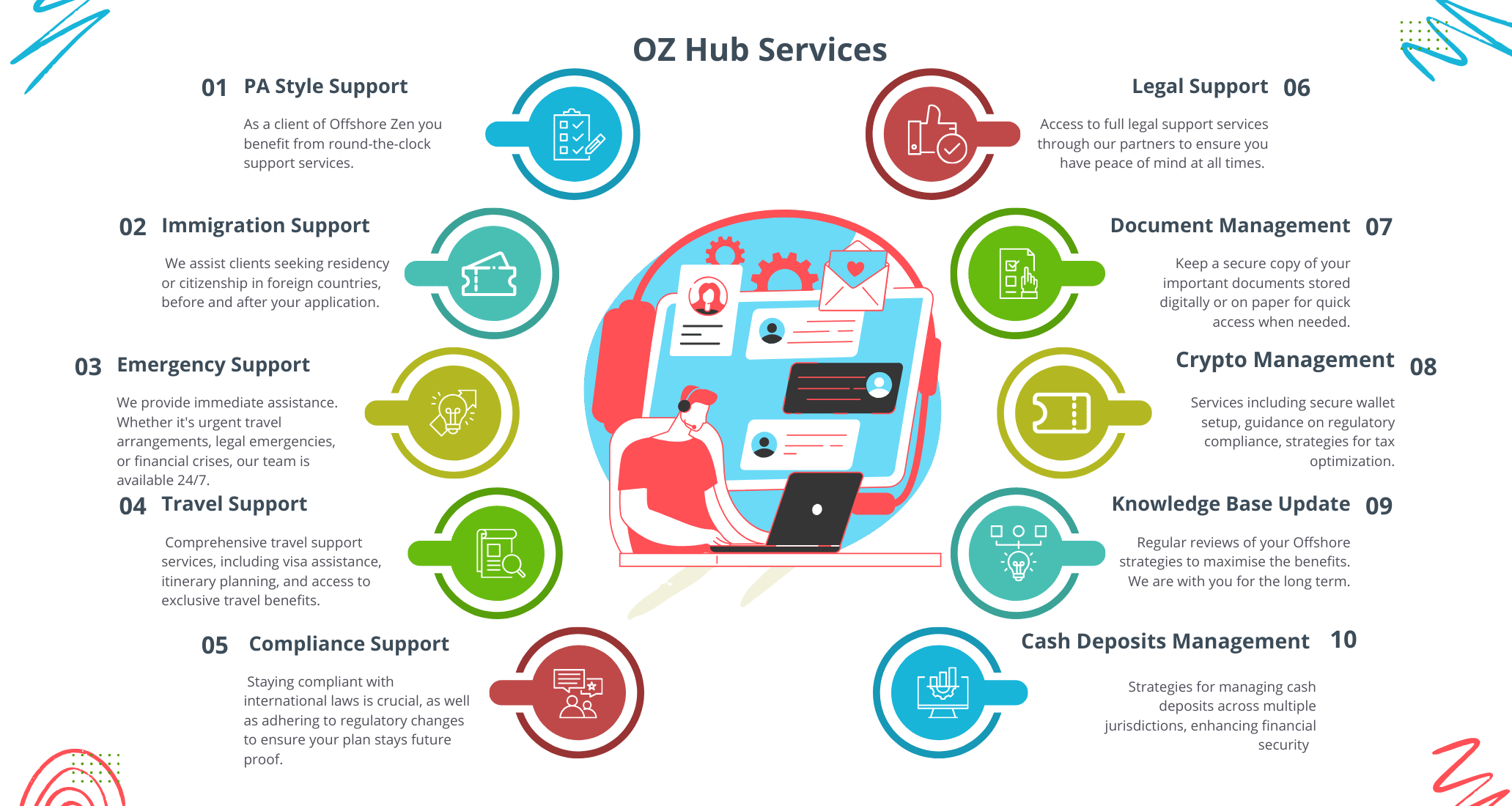

Our 24/7 client Hub service offers all of our clients support in normal day-to-day activities as well as in times of crisis.

As such, our growth is limited to ensure an ongoing high-value service for all our clients.

In today’s unpredictable world, events ranging from geopolitical instability and economic shocks to natural disasters or personal crises can instantly jeopardise access to essential financial resources.

It’s essential to have plans in place for various emergency scenarios, including natural disasters, health crises, or economic downturns. Your personal and financial security may depend on it.

The Escape Plan is designed for those clients who want a solid Plan B in place should the need arise. It’s a higher level of longer-term protection of assets and personal security. You perhaps have no intention of leaving your current country, but want to be able to move on short notice should the need arise.

Our 24/7 client Hub service offers all of our clients support in normal day-to-day activities as well as in times of crisis.

As such, our growth is limited to ensure an ongoing high-value service for all our clients.

Whilst most people should have a Financial Go Pack, and those with the financial means should have a good Escape Plan (Plan B), a fully Bespoke Offshore Plan is not for everyone, as the benefits must outweigh the costs. But don’t worry, during the Free Initial meeting, we will identify the best solutions for you.

Finely tuned over the years to provide convenience and efficiency our Client Hub, will help you manage all your offshore requirements under one secure roof.

Accessible anytime, anywhere, our Client Hub ensures streamlined communication, real-time updates, and comprehensive oversight of your offshore ventures. At OffshoreZen.com, we are dedicated to delivering transparent, reliable, and client-centric services that empower you to thrive in the global marketplace.

With 24-hour concierge-style support services.

All Plans come with access to the full Hub services and 24-hour crisis support.

The Financial Go Plan (Formerly Pack) is a tailored financial safety net designed to ensure immediate liquidity, asset protection, and strategic support during emergencies. Whether it's a natural disaster, political unrest, or personal crisis, this plan ensures you’re prepared to act quickly and protect your financial stability.

With an Offshorezen Managed Go Plan cash is available immediately via card or transfer or MoneyGram. Gold held in storage can normally be sold and converted to cash with 2 hours during working hours.

For self managed go plans the international banking partnerships, funds can typically be accessed via card immediately. Either way ensuring you have immediate liquidity when it matters most.

Absolutely. In addition to ensuring liquidity, we provide crisis management support, relocation assistance, and access to a global network of experts, including legal and logistical specialists. We are By your side 24/7.

Yes, payments are flexible for example you may wish to start your plan around the $9,000 USD level for increased confidentiality.

It is really a question of control. With a managed plan the funds and assets sit under our segregated trusts, or in client Escrow. This means the assets are outside your estate and protected from the many risks discussed above. This benefit comes without cost to you.

With a managed plan you will set up offshore accounts directly in your name reducing the protection. You could setup offshore vehicles to add a layer of protection but at increased costs sometimes disproportionally high. Go Plans are designed to provide 3 months liquidity while you overcome a crisis. The size should reflect this. For longer term planning our Escape Plans and Offshore Plans are more appropriate.

Yes, payments are flexible for example you may wish to start your plan around the $9,000 USD level for increased confidentiality.

Yes. Each plan is tailored to align with your specific financial situation, risk tolerance, and goals. Normally you should plan for 3 months of liquidity. This number will vary client to client. The minimum Go Plan is USD$10,000, but this can be built up over a number of smaller payments if required.

We assess your unique circumstances to build a robust, personalized solution that's best for you. Some plans are a mixture of managed and self managed.

The Go Plan is designed for short term emergency preparedness, and forms part of an overall long term plan. The Escape Plans and Offshore Plans include components like tax optimization, asset protection, and investment strategies to secure and grow your wealth in the long term. During your Free meeting we will happily discuss your long term plans to see how we can help.

Contact us today, we will give you the best impartial advice.

Complete our Free meeting form, or give us a nudge on the live chat, Whatsapp or Telegram. Or contact us here.

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.