Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

The timeless allure of gold has once again captured the global imagination. As prices flirt with historic highs, a pressing question echoes through the financial world: Is it too late to buy gold? For the seasoned investor and the everyday prepper alike, the answer is complex, woven from a tapestry of geopolitical uncertainty, economic anxieties, and the enduring debate over what constitutes true value.

This article will delve into the heart of this question, examining the arguments from leading commentators and providing a balanced perspective on whether the sun is setting on this golden opportunity or just beginning to rise.

The landscape for gold in the mid-2020s is nothing short of dramatic. A confluence of factors, including persistent inflation, escalating geopolitical tensions, and a notable surge in central bank acquisitions, has propelled the yellow metal to the forefront of financial discussions. For many, this surge is a clear sign to get in on the action. For others, it’s a classic case of “fear of missing out” on an asset that may be nearing a peak.

To navigate this terrain, it is essential to consider the compelling cases made by some of the most respected and vocal commentators in the financial arena.

Why the Golden Rally Has Just Begun

Proponents of gold investment see the current climate not as a deterrent, but as a powerful confirmation of the metal’s enduring relevance. They argue that the fundamental drivers of the recent price appreciation are not fleeting, but rather indicative of a long-term secular trend.

Peter Schiff’s Warning

Economist and vocal gold advocate Peter Schiff has long been a proponent of gold as a safe haven against what he views as the inevitable debasement of fiat currencies, particularly the US dollar. In a recent statement, Schiff declared, “Gold is not just any commodity, it’s money.” He argues that the significant rally in gold in recent years is a direct indictment of the US dollar’s diminishing purchasing power and global standing. As he noted in an April 2025 post on X, “This is the end of the US dollar’s dominance. Life in America is about to change in ways few can imagine.”

Schiff’s thesis is rooted in the belief that central banks, particularly the Federal Reserve, have created an economic environment of excessive debt and currency creation. For him, the rising price of gold is not a bubble, but a reflection of the dollar’s “reverse bubble” bursting. His advice is unequivocal: acquire physical gold before the masses catch on. He suggests that by the time gold becomes a mainstream media fixation, the most significant gains will have already been realized. For Schiff and his followers, it is far from too late; in fact, it’s a critical time to act.

At Offshorezen we suggest clients always own gold across all of our plans. We believe gold and silver will always have a role. Incorporating gold into your financial plan offers:

Buying gold is a time-tested method to preserve wealth and ensure financial resilience.

Jim Rickards’s Perspective

James Rickards, an economist and author of “The New Case for Gold,” offers a more structural argument for the continued rise of gold. He posits that the world is in the midst of a fundamental shift in the international monetary system. Rickards highlights the unprecedented levels of gold accumulation by central banks, particularly from countries like China and Russia, as a clear signal of a move away from the US dollar as the sole reserve currency.

In a May 2025 market outlook, Rickards noted, “We’ve entered uncharted territory for gold prices, supported by fundamentally different market dynamics than previous price peaks.” He argues that this is not merely a cyclical trend but a strategic repositioning by major global players who are losing faith in the long-term stability of the US financial system. Rickards sees gold as the only financial asset with zero counterparty risk, making it the ultimate safe harbour in a world of increasingly interconnected and fragile financial systems. His analysis suggests that the current price levels are just the beginning of a significant revaluation of gold in the global financial order. He has put forward price targets that seem audacious to some, but to him, are a logical consequence of the unfolding economic landscape.

Beyond the arguments of individual commentators, a powerful case for gold is being made by the daily headlines. The intensification of conflicts, such as the war in Ukraine, and the simmering tensions in the Middle East and between the US and China, create a fertile ground for safe-haven assets. As noted by Trevor Hall at the Mines and Money London 2025 conference, “Gold is trading higher not just because of fear, but because that fear is now multi-dimensional.” This “multi-dimensional” fear encompasses not just military conflict, but also trade wars, sovereign debt crises, and the potential for a global recession. In such an environment, gold’s historical role as a preserver of wealth during times of turmoil becomes paramount.

On the other side of the golden coin are the skeptics, who view the current enthusiasm with a healthy dose of caution. They argue that gold’s recent performance is a reason for concern, not celebration, and that investors should be wary of chasing a rally.

Warren Buffett’s Unwavering Stance

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has never been a fan of gold as an investment. His argument is simple and has been consistent for decades: gold is an unproductive asset. In his 2011 letter to shareholders, he famously quipped, “Gold gets dug out of the ground in Africa or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Buffett’s investment philosophy is centred on acquiring productive assets businesses that generate earnings, pay dividends, and create tangible value. Gold, in his view, does none of these things. Its value is entirely dependent on what someone else is willing to pay for it in the future, a concept he likens to the “greater fool theory.” He has often contrasted the performance of gold with that of American businesses over the long term, arguing that the latter has been a far superior engine of wealth creation. While he acknowledges that fear can drive gold prices up, he sees this as a speculative frenzy rather than a sound investment strategy. For Buffett, the question isn’t whether it’s too late to buy gold, but why one would want to buy it at all when there are productive businesses to invest in.

Another significant concern for potential gold investors is the risk of buying into a crowded trade. When an asset becomes as popular as gold has in recent times, there is a danger that its price has been driven up more by momentum and speculation than by fundamental value. As with any asset that has seen a rapid price increase, the potential for a sharp correction is very real.

Furthermore, despite its reputation as a “safe” asset, gold can be remarkably volatile. Its price is influenced by a complex interplay of factors, including interest rate expectations, currency fluctuations, and investor sentiment. While the long-term trend may be upward, the journey can be a turbulent one, with significant drawdowns that can test the resolve of even the most committed investor.

A Tool for Diversification and Preparedness

So, where does this leave the individual investor or prepper? The debate between the bulls and the bears highlights a crucial point: gold’s role in a portfolio is not necessarily to generate spectacular returns, but to provide a unique form of insurance.

The Diversification Imperative

One of the most compelling arguments for including gold in a portfolio is its low correlation with other asset classes like stocks and bonds. During periods of market stress, when traditional investments may be declining, gold often moves in the opposite direction. This can help to smooth out portfolio returns and reduce overall volatility. Financial advisors often recommend a modest allocation to gold, typically in the range of 5% to 10%, as a way to diversify and hedge against unforeseen market events.

A Tangible Asset in Uncertain Times

For those with a financial prepping mindset, the case for gold is even more compelling. In a true crisis scenario, where financial systems may be disrupted or currencies may lose their value, physical gold offers a tangible, universally recognized store of wealth. Unlike digital assets or paper currency, it cannot be erased or devalued by government decree.

When considering gold for prepping, the distinction between physical gold and “paper gold” (like ETFs) becomes critical. While gold ETFs offer a convenient and low-cost way to gain exposure to the price of gold, they do not provide direct ownership of the metal. In a systemic crisis, the counterparty risk associated with ETFs could become a significant concern. For the prepper, owning physical gold, whether in the form of coins or small bars, provides a level of security and independence that paper assets cannot match.

It is a form of wealth that can be held outside of the traditional financial system, offering a last line of defence in the face of a worst-case scenario. Its a major elemenet of our Financial Go Plans

A Timeless Asset for Uncertain Times

To return to our central question: Is it too late to buy gold?

The answer, it seems, depends on your perspective and your objectives. If you are seeking a short-term, speculative gain, then the risks of buying at or near an all-time high are considerable. The admonitions of commentators like Warren Buffett regarding gold’s lack of productivity should be carefully considered.

However, if you view gold not as a get-rich-quick scheme but as a long-term store of value, a hedge against economic and geopolitical turmoil, and a crucial component of a diversified portfolio, then the argument for owning it remains as strong as ever. The structural shifts in the global economy, the persistent threat of inflation, and the ever-present reality of geopolitical instability are powerful tailwinds that are likely to support gold’s value for the foreseeable future.

For the clients of Offshorezen, and the Neville Montagu Group, who understand the importance of resilience and self-reliance, gold offers a unique proposition. It is an asset that transcends borders and financial systems, a timeless symbol of wealth and security. While the price of gold will undoubtedly continue to fluctuate, its fundamental role as a solid part of any well-rounded portfolio and a cornerstone of financial preparedness is unlikely to diminish. In a world of increasing uncertainty, the warm glow of gold may be more than just an attractive investment; it may be a beacon of stability in a turbulent sea.

Creating a solid Financial Go Plan that includes offshore bank accounts and gold investments is one of the smartest moves you can make in today’s uncertain climate. It’s about more than just protecting assets; it’s about taking control of your financial future with a plan that gives you peace of mind, no matter what global events arise.

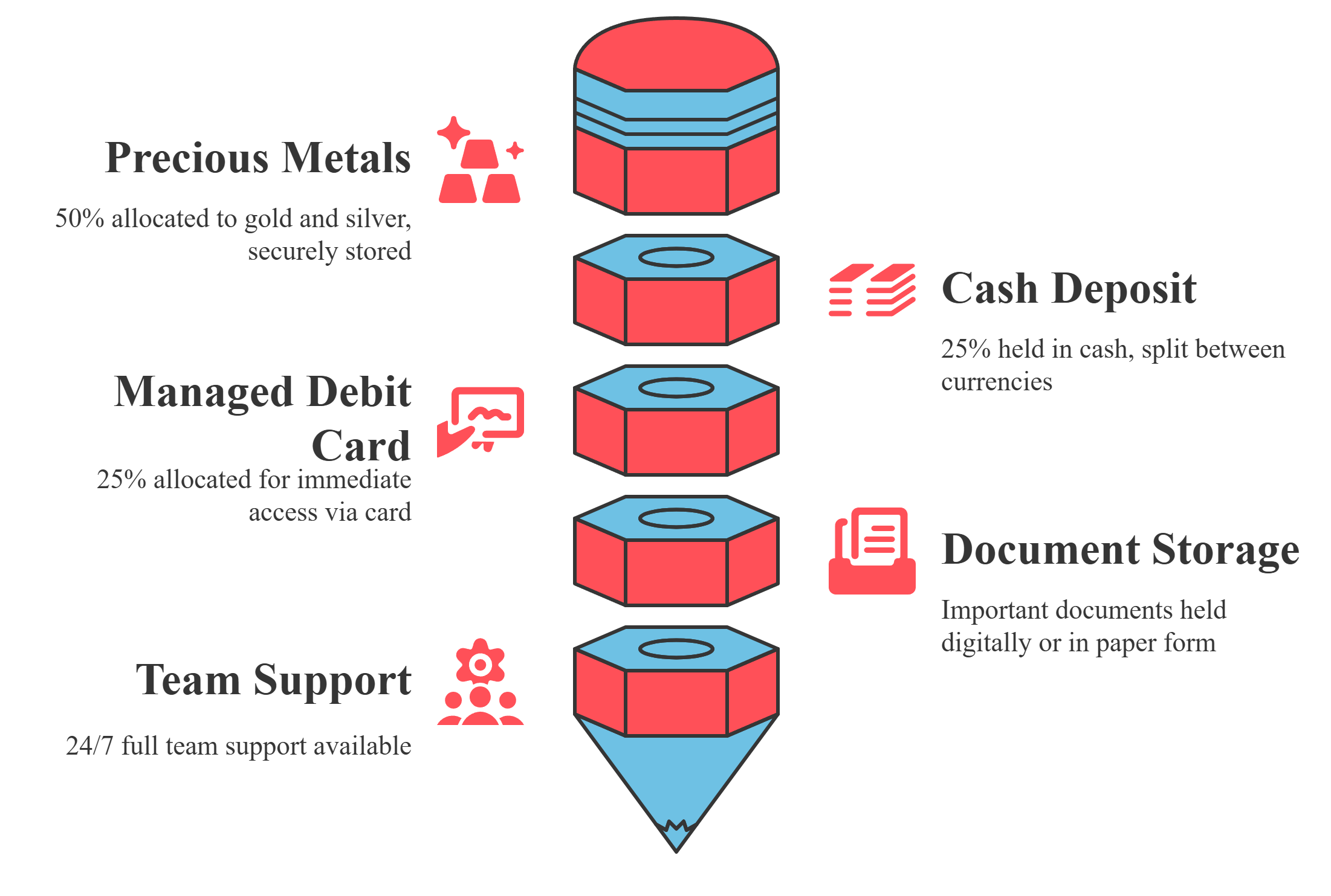

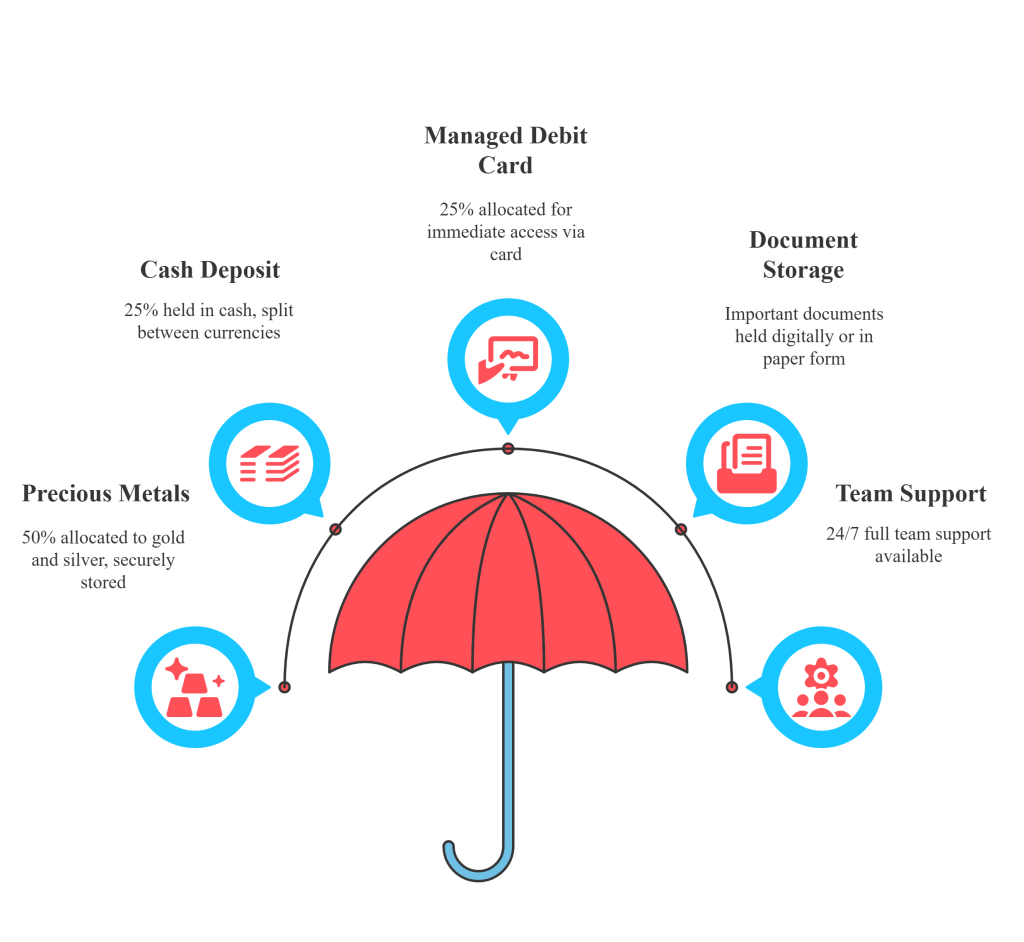

Offshore Zen’s Financial Go Plan, available in both Managed and Self-Managed formats, adds a critical layer of financial security. By allocating liquid assets offshore and integrating round-the-clock crisis response, we ensure you’re never caught off guard.

The Managed plan is ideal for fast, streamlined protection of smaller holdings, while the Self-Managed plan is tailored for those looking for greater autonomy over substantial assets. Your risk appetite, asset size, and personal goals will shape the right strategy, giving you the clarity and confidence to move forward securely.

When markets shift and global systems get shaky, you need a reliable partner who’s ready around the clock. Offshore Zen’s 24/7 Hub services deliver real-time support, helping you act swiftly and smartly. Whether you’re buying gold as a hedge, managing international assets, or building a nest egg overseas, we provide the tools and expert guidance you need to stay one step ahead.

Whether you’re an entrepreneur, investor, or expatriate, Offshore Zen equips you with the peace of mind, freedom, and flexibility to operate confidently no matter where life takes you. Don’t wait for the next emergency to plan ahead.

Let’s talk now and prepare a Financial Go Plan that truly protects what matters.

Financial Go Plans and Escape plans are proactive and strategic approaches to preparing for unforeseen challenges, uncertainties, or emergencies. The specific reasons for needing them can vary depending on your individual circumstances.

An Offshore Plan is a combination of strategies that involves the use of Offshore Companies, Trusts, Offshore Banking and Visa or Immigration services. The aim is to legally reduce your taxes, protect your privacy and secure your assets. At the same time, save money and grow your assets through diversification.

All these strategies require more than one speciality and usually utilize the benefits of more than one jurisdiction and partners such as law firms, trustees and banks.

Our partners are chosen on merit as leaders in their field. We act on your behalf, always ensuring the best advice for you.

Asset Protection and Wealth Security have never been more important. Being prepared for any event to ensure you always have Financial liquidity and Freedom.

We would love to hear from you if you have any questions or need assistance. Contact us. Or chat with us on WhatsApp or Telegram now.

Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

Understanding these processes is essential for anyone seeking to manage and protect their wealth, as the lines between legitimate wealth...

At Offshorezen.com, we specialize in providing robust, rapid, and discreet offshore asset protection solutions designed to safeguard your financial future.

The top-tier jurisdictions have created legal environments that make it procedurally difficult and expensive for a creditor to pursue assets...

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.