Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

As commercial lawyers, we often speak with clients who are considering expanding their business operations globally or seeking to protect their assets through international structures. The world of offshore companies and Company Formations can seem complex, but with the right guidance, it offers a wealth of strategic advantages.

At OffshoreZen, we pride ourselves on partnering with high-quality local law firms in each region to ensure our clients receive top-tier, competitive service. We believe in providing our clients with the best advice, which is why we offer a free consultation to help you make informed decisions tailored to your unique circumstances. This article aims to introduce you to the fundamental concepts of offshore companies and demonstrate why the reason for your company’s existence will profoundly influence the location you choose.

What is an Offshore Company?

An offshore company is a legal entity that is incorporated in a jurisdiction other than where its principals or owners reside and conduct their primary business. The term “offshore” historically referred to islands or coastal jurisdictions, but it now encompasses any country or territory that offers a favourable business environment, often including tax benefits, simplified regulations, and enhanced confidentiality. It is important to distinguish between legitimate and illegitimate uses of these structures. Legally, individuals and businesses incorporate offshore for numerous valid reasons, such as:

The format of an offshore company is often dictated by its intended purpose. Understanding the different types available is crucial for selecting the right structure.

International Business Company (IBC)

The IBC is perhaps the most widely recognised and popular type of offshore company. Jurisdictions such as the British Virgin Islands, Belize, and Seychelles have built their financial services industries around this structure. An IBC is typically designed for international trade, consulting, holding companies, and asset protection.

Limited Liability Company (LLC) and Limited Liability Partnership (LLP)

These entities are popular in the US and UK respectively, and their offshore counterparts combine the limited liability of a corporation with the tax efficiency of a partnership.

EU Holding Companies for International Investment

Certain EU member states, such as Luxembourg, Cyprus, and Malta, have established favourable holding company regimes. These jurisdictions are particularly attractive for international investors and corporations.

Personal Service Companies (PSCs)

A PSC is a company through which an individual, usually a contractor or consultant, provides their services to clients. They are often used to reduce administrative costs and improve tax efficiency.

How to Choose the Right Offshore Company Structure for Your Business

Selecting the appropriate offshore company structure is a crucial decision that should be based on a thorough analysis of your business needs. As your business goals will very much influence the location chosen, here are the key factors to consider:

Compliance and Substance: Modern international regulations (e.g., Economic Substance requirements) mean that simply having a company in an offshore location is no longer sufficient. You must be able to demonstrate that the company has genuine operational substance in that jurisdiction. This might involve having a physical office, local employees, and conducting core income-generating activities there.

When you decide to incorporate offshore, the location is paramount. Each jurisdiction has unique strengths, making it suitable for specific types of businesses. Here, we outline six of the best offshore locations and their primary uses, including their specific tax advantages.

The British Virgin Islands (BVI)

The BVI is arguably the world’s most famous and popular offshore jurisdiction. It is a politically stable British Overseas Territory with a legal system based on English common law, offering a highly secure environment. The BVI Business Company (BVI BC) is the primary vehicle here.

The Cayman Islands

Known as a global financial powerhouse, the Cayman Islands is a top-tier jurisdiction, particularly for institutional investors. Its legal and regulatory framework is robust and respected worldwide.

The United Arab Emirates (UAE)

The UAE has emerged as a dynamic and highly attractive offshore destination, especially within its free zones like the Ras Al Khaimah (RAK) and Jebel Ali Free Zone (JAFZA). It is a strategic hub for trade and commerce between East and West.

Panama

Panama has a long history as an international banking and financial centre. Its territorial tax system means that companies are only taxed on income generated within Panama, making it highly advantageous for foreign-sourced income.

Hong Kong

As a Special Administrative Region of China, Hong Kong offers a unique blend of a common law legal system and proximity to the vast Asian markets. It is a highly respected and transparent jurisdiction.

Belize

Belize is known for its cost-effectiveness and rapid incorporation process. It offers a tax-neutral environment and strong privacy standards, making it a popular choice for small to medium-sized enterprises.

The decision to establish an offshore company is a strategic one that can offer significant benefits in terms of tax efficiency, asset protection, and global business expansion. However, it requires careful consideration of your specific goals and circumstances. This is where professional advice becomes indispensable.

Our team at Offshore Zen, together with our network of legal partners, is dedicated to helping you navigate this landscape. We offer a free, no-obligation consultation to discuss your needs and guide you toward the most suitable offshore jurisdiction and company structure for your future success. We are here to ensure that your venture is built on a solid, legally sound foundation, allowing you to focus on your business with confidence.

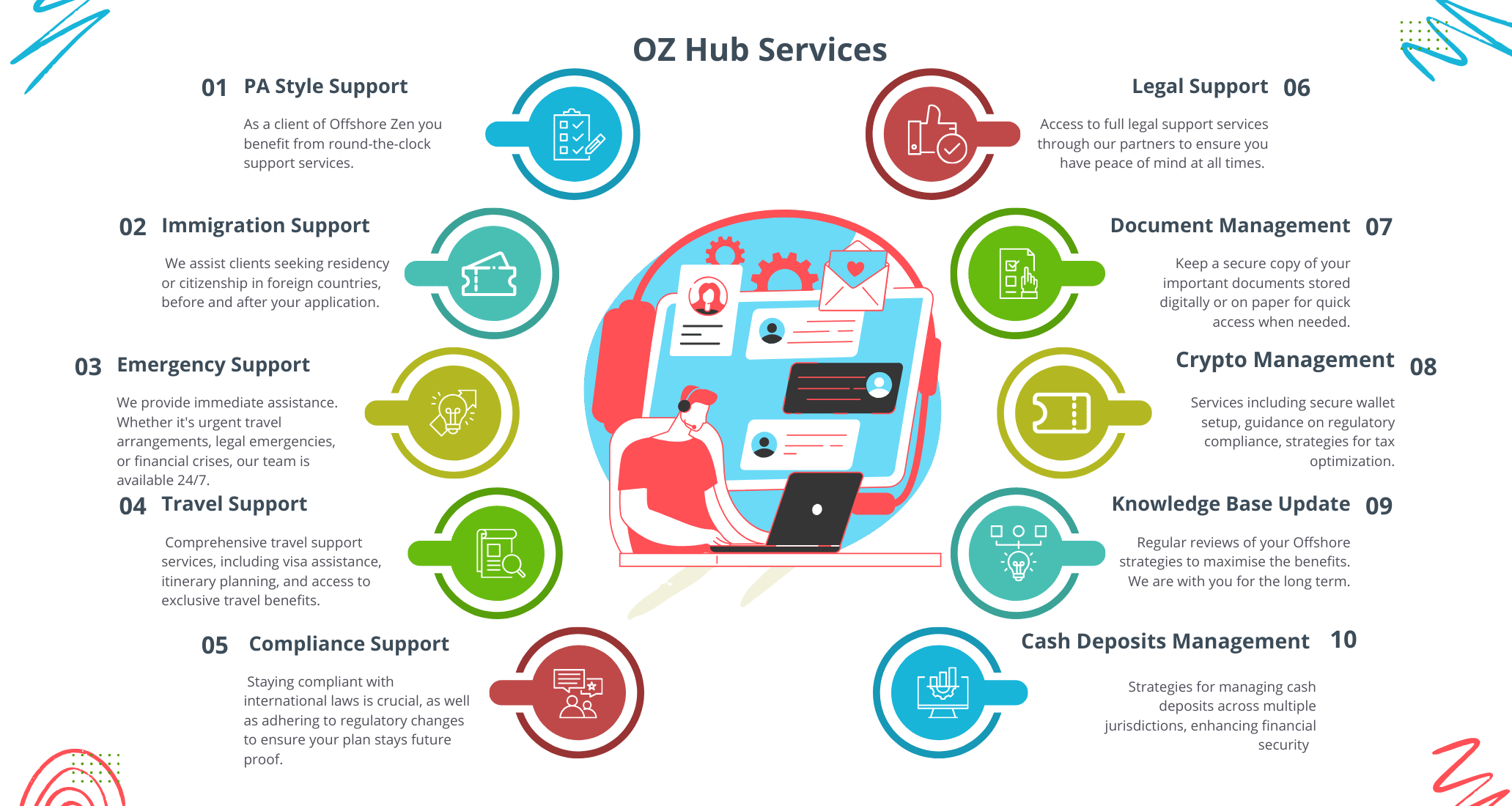

When markets shift and global systems get shaky, you need a reliable partner who’s ready around the clock. Offshore Zen’s 24/7 Hub services deliver real-time support, helping you act swiftly and smartly. Whether you’re buying gold as a hedge, managing international assets, or building a nest egg overseas, we provide the tools and expert guidance you need to stay one step ahead.

Whether you’re an entrepreneur, investor, or expatriate, Offshore Zen equips you with the peace of mind, freedom, and flexibility to operate confidently no matter where life takes you. Don’t wait for the next emergency to plan ahead.

Let’s talk now and prepare a Financial Go Plan that truly protects what matters.

Financial Go Plans and Escape plans are proactive and strategic approaches to preparing for unforeseen challenges, uncertainties, or emergencies. The specific reasons for needing them can vary depending on your individual circumstances.

An Offshore Plan is a combination of strategies that involves the use of Offshore Companies, Trusts, Offshore Banking and Visa or Immigration services. The aim is to legally reduce your taxes, protect your privacy and secure your assets. At the same time, save money and grow your assets through diversification.

All these strategies require more than one speciality and usually utilize the benefits of more than one jurisdiction and partners such as law firms, trustees and banks.

Our partners are chosen on merit as leaders in their field. We act on your behalf, always ensuring the best advice for you.

Asset Protection and Wealth Security have never been more important. Being prepared for any event to ensure you always have Financial liquidity and Freedom.

We would love to hear from you if you have any questions or need assistance. Contact us. Or chat with us on WhatsApp or Telegram now.

Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

Understanding these processes is essential for anyone seeking to manage and protect their wealth, as the lines between legitimate wealth...

At Offshorezen.com, we specialize in providing robust, rapid, and discreet offshore asset protection solutions designed to safeguard your financial future.

The top-tier jurisdictions have created legal environments that make it procedurally difficult and expensive for a creditor to pursue assets...

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.