Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

In an increasingly interconnected world, individuals and businesses are no longer geographically bound. Technology enables remote work, global investment portfolios are commonplace, and entrepreneurs can establish companies far from their place of birth. This globalization has intensified the search for jurisdictions offering favorable tax environments – places often referred to as “tax havens,” though the reality is far more nuanced. These locations range from countries with zero income tax whatsoever to those with territorial systems or specific low-tax regimes. Identifying the countries with lowest tax burdens globally requires looking across continents and understanding different systems.

The allure is obvious: keeping more of your hard-earned money. Whether you’re a high-net-worth individual (HNWI), a digital nomad embracing location independence, a retiree seeking to stretch your pension, or an entrepreneur building an international business, understanding the global landscape of low-tax countries is a critical first step. This includes looking at options both within and outside Europe, comparing them to find the absolute best fit. While many seek low tax countries in Europe, the global stage offers even more variety.

This article explores some of the world’s most attractive low-tax and tax-free countries in 2025, spanning different continents and types of tax systems. We’ll examine their key features, potential benefits, and the crucial factors to consider. However, international tax law is notoriously complex and constantly evolving. Information presented here is for general understanding and cannot replace bespoke advice from qualified legal and tax professionals who understand your unique circumstances.

Not all “tax havens” are created equal. They generally fall into several categories:

Zero Income Tax Countries: These nations impose no income tax on individuals. They represent the ultimate “tax-free” destination for personal earnings.

Territorial Tax Countries: These jurisdictions primarily tax income earned or sourced within their borders. Foreign income may be exempt, making them function like tax-free havens for international earners.

Low Tax Countries: These countries do levy income tax, but at significantly lower rates (often flat rates) than major economies. Many low tax countries in Europe fall into this category, alongside global counterparts. They aim for simplicity and competitiveness.

Countries with Special Regimes: Some nations offer specific tax incentives like non-domiciled status (similar to some European tax free countries for unremitted income), lump-sum taxation, or residency/citizenship by investment programs with tax advantages.

Let’s explore some prominent examples from around the world, including some of the countries with the lowest tax:

What sets Offshore Zen apart is our commitment to holistic support. We don’t just address isolated issues; we anticipate your needs and provide proactive solutions. Here are some additional benefits of partnering with our Hub:

Choosing a global tax haven involves more than picking the country with the lowest rate:

The world map is dotted with countries offering compelling tax advantages. From zero-tax regimes to territorial systems and specialized low-tax options both within and beyond Europe, the choices are vast. Whether considering established low tax countries in Europe or venturing further afield to find the global countries with lowest tax, opportunities exist.

However, the path to successful international tax optimization is complex. Understanding residency, income sourcing, treaties, home country rules, and compliance is paramount. A seemingly attractive low rate can be negated by high costs or instability.

Therefore, while exploring these global havens, including European tax free countries and their worldwide counterparts, is worthwhile, making a move requires thorough research and consultation with experienced international tax advisors. They can help navigate the intricate regulations, ensure compliance, and structure your affairs effectively in our increasingly borderless world.

Life’s uncertainties and complexities demand a partner who’s always ready to help. Offshore Zen’s 24/7 Hub services offer unparalleled support, ensuring you can navigate crises and streamline daily operations with ease. Whether you’re an entrepreneur, an investor, or an expatriate, having Offshore Zen by your side means peace of mind, financial freedom, and the confidence to tackle any challenge.

Don’t wait for the unexpected to happen. Partner with us today and experience the power of having our experts and partners at your disposal, 24/7. Arrange a free meeting here.

We started business as UK Independent Financial Advisors in 1993 and expanded offshore in 1998. Our initial focus was helping British Expatriates with tax and investment planning, providing access to a variety of pension and savings products.

Over the last few decades, we have broadened our advisory services to offer a fully inclusive one-stop service moving away from insurance and pension sales to focus on creating fully bespoke offshore plans for our clients. Ensuring our clients receive the very best advice and ongoing support from our network.

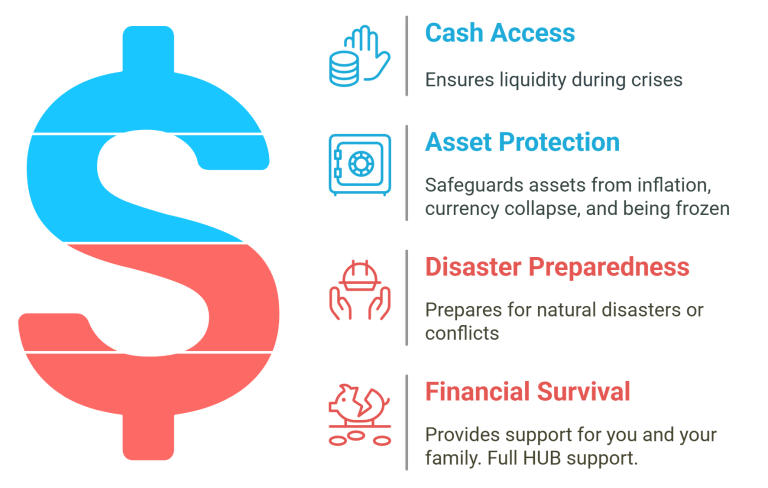

Asset Protection and Wealth security have never been more important. Being prepared for any event to ensure you always have Financial liquidity and Freedom.

We offer three key strategies to ensure clients at all wealth levels can secure and grow their wealth bust most importantly can have peace of mind.

We would love to hear from you if you have any questions or need assistance. Contact us. Or chat with us on WhatsApp or Telegram now.

Thinking of going global? An offshore company formation can be a powerful strategy for international business and asset protection. An...

Understanding these processes is essential for anyone seeking to manage and protect their wealth, as the lines between legitimate wealth...

At Offshorezen.com, we specialize in providing robust, rapid, and discreet offshore asset protection solutions designed to safeguard your financial future.

The top-tier jurisdictions have created legal environments that make it procedurally difficult and expensive for a creditor to pursue assets...

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.