This is a (fictional) basic client case study. The client who lives in the USA and is facing litigation and is worried his assets will be seized. We explain in very basic detail an offshore structure that would allow him to transfer all his USA based assets so that they would be protected if he was to lose the litigation claim. He also wants to trade gold and silver so we explore explain a way for him to do this, best location and best services. This is just an example explained in simple terms, should not be taken as legal advice.

Client: Henry Williams

Residence: United States

Concern: Potential asset seizure due to pending litigation

Objective: To safeguard assets through offshore structuring and to explore opportunities in trading precious metals.

Henry, a U.S. resident and entrepreneur, was facing a significant legal challenge that could potentially result in asset seizure. With substantial assets within the U.S., Henry sought a secure offshore structure to protect his wealth. Additionally, Henry was interested in diversifying his investments by trading gold and silver.

Offshore Trust Formation

Considering Henry’s situation, the establishment of an offshore trust was advised as the optimal solution for asset protection.

Best Structure:

An Offshore Asset Protection Trust with Henry as the settlor, transferring his at risk assets into the trust.

Ideal Jurisdiction: Cook Islands

Recognized for robust asset protection laws.

Resistant to foreign judgments, making it difficult for U.S. creditors to reach trust assets.

Provides a legal framework that prioritizes the protection of settlor assets.

Offshore Trust Formation

Considering Henry’s situation, the establishment of an offshore trust was advised as the optimal solution for asset protection.

Best Structure:

An Offshore Asset Protection Trust with Henry as the settlor, transferring his at risk assets into the trust.

Ideal Jurisdiction: Cook Islands

Recognized for robust asset protection laws.

Resistant to foreign judgments, making it difficult for U.S. creditors to reach trust assets.

Provides a legal framework that prioritizes the protection of settlor assets.

Important Consideration:

Asset transfers to offshore trusts must be done before any legal judgments. Transferring assets after a claim has arisen can be contested as fraudulent conveyance.

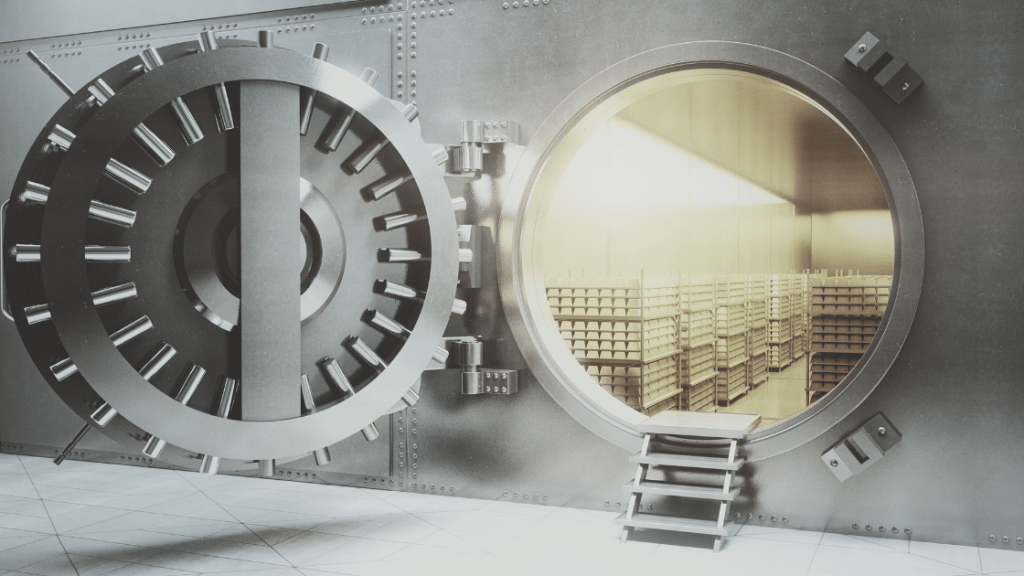

To further diversify his portfolio and invest in precious metals, Henry expressed interest in trading gold and silver.

Highly regarded Location for Precious Metals Trading: Switzerland

Why Switzerland:

Switzerland is globally recognized for its stability and expertise in precious metal trading.

It offers secure storage facilities and well established metal trading companies.

The country’s political neutrality and strong private property rights provide a favourable environment for precious metals investors.

Banks in Switzerland that specialize in precious metals can offer services for buying, selling, and storing physical gold and silver.

Henry can access international trading platforms that allow for the trading of gold and silver, both physically and electronically.

Switzerland is renowned for its secure vault services, ensuring the safekeeping of physical precious metals.

Henry can engage with firms that provide comprehensive wealth management services, including investment in precious metals as part of a diversified portfolio.

Trading Strategy:

Henry can invest in physical gold and silver, stored in secure vaults, or he can invest in various financial instruments that represent gold and silver on the markets.

Tax Implications:

Henry should be aware that as a U.S. citizen, he is subject to tax reporting on worldwide income, including gains from precious metals trading although steps can be taken to greatly delay or reduce this.

Henry’s asset protection and investment strategy require careful planning and timing, especially in light of potential litigation. Establishing a Cook Islands Asset Protection Trust offers a viable solution for safeguarding his assets, while trading gold and silver through Swiss based services provides a sound investment diversification strategy. In reality, such a solution would most likely involve the use of multiple jurisdictions and offshore company formations.

For a successful outcome, Henry must seek expert legal and financial advice to navigate the complex regulatory and tax obligations involved in offshore structuring and precious metals trading.

A bespoke offshore financial plan needs to be carefully designed, taking into account the individual’s or business’s financial goals, risk tolerance, and the legal and regulatory implications in both the home country and the offshore jurisdiction.

At OffshoreZen you can access expert advice all under one roof. Book a Free Meeting now to find out how we can help you.

We started business as UK Independent Financial Advisors in 1993 and expanded offshore in 1998. Our initial focus was helping British Expatriates with tax and investment planning, providing access to a variety of pension and savings products.

Over the last few decades, we have broadened our advisory services to offer a fully inclusive one-stop service moving away from insurance and pension sales to focus on creating fully bespoke offshore plans for our clients. Ensuring our clients receive the very best advice and ongoing support from our network.

Asset Protection and Wealth security have never been more important. Being prepared for any event to ensure you always have Financial liquidity and Freedom.

We offer three key strategies to ensure clients at all wealth levels can secure and grow their wealth bust most importantly can have peace of mind.

We would love to hear from you if you have any questions or need assistance. Contact us. Or chat with us on WhatsApp or Telegram now.

This website may be accessed worldwide. However, none of the products and services referred to on this website are available to recipients residing in countries where the provision of such products and services would violate mandatory applicable legislation or regulations. It is the sole responsibility of any recipient employing or requesting a product or service to comply with all applicable legislation or regulations. Information provided on OffshoreZen.com is for information and educational purposes only; it is not legal or financial advice. Your personal situation is unique, and the products and services we review may not be right for your circumstances.

As part of the Neville Montagu Group, OffshoreZen adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are ours alone and have not been provided, approved, or otherwise endorsed by our partners.

Neville Montagu is an appointed representative of NEBA Wealth Management. NEBA Wealth Management group with multi-jurisdictional licenses in locations such as the UAE, Singapore, the United Kingdom, Malaysia & South Africa.

© Offshore Zen Group 2024.

@ 2025 Offshorezen.com All rights reserved.